Xinda Finance Comprehensive Front-end System

Xinda Finance Integrated Front-end Management System

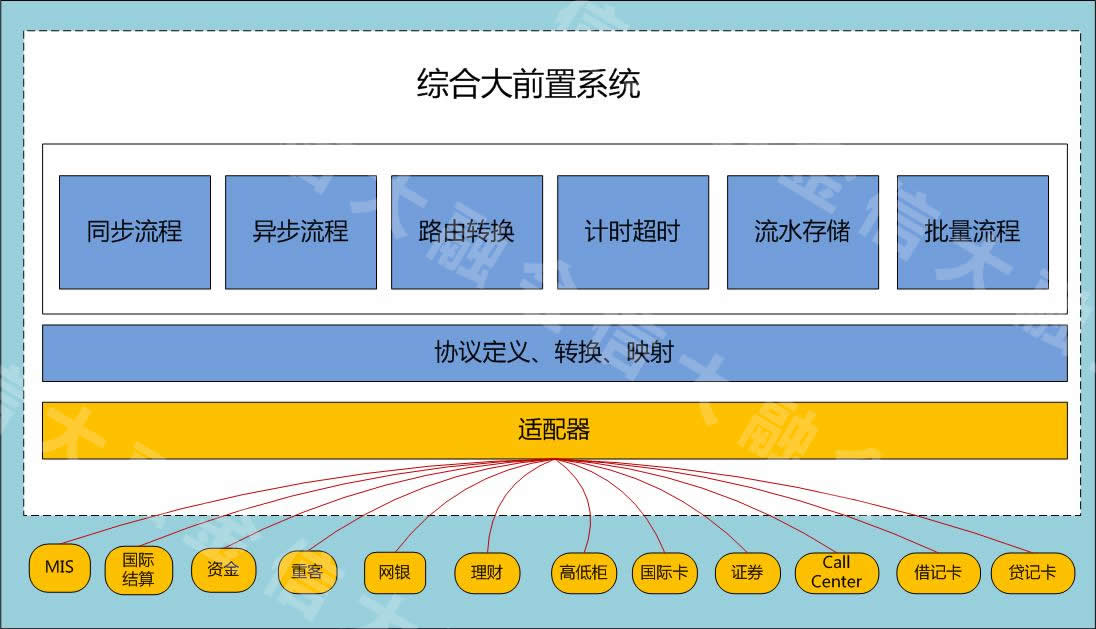

Drawing on over a decade of accumulated experience, our proprietary 【MCDS】 product offers commercial banks a comprehensive large front-end solution and a range of business front-end system solutions. It has been widely and successfully deployed in numerous commercial banks nationwide. The "MCDS-Comprehensive Large Front-end System" solution, with its advanced design concepts and cutting-edge technology, comprehensively assists commercial banks in achieving a "lean core-large periphery" architectural trend. It establishes a secure and stable operational system centered around the customer, enhances the bank's management and decision-making capabilities, and improves market risk control and responsiveness.

Integrated front-end system | ||

Serial number | System Name | Scope of Business |

1 | UnionPay Front-end System | Balance inquiry, withdrawal, purchase, purchase reversal, purchase cancellation, deposit, deposit cancellation, deposit confirmation, return, pre-authorization, additional pre-authorization, pre-authorization cancellation, pre-authorization completion, sign-in/sign-out, key reset, date change, line testing, etc. |

2 | Clearing and Settlement System | Clearing file parsing, total reconciliation, fund settlement, reconciliation, clearing, file processing, merchant settlement. |

3 | Bank IC Card System | IC card transactions mainly consist of online transactions, offline transactions, and management transactions. For example, transactions across different channels such as inquiries, withdrawals, purchases, pre-authorizations, offline purchases, offline pre-authorizations, as well as functions like check-in/check-out, key management, and management of black, gray, and white lists. This section focuses on explaining online and offline transactions of IC cards, including transaction types, transaction processes, and IC card transaction management functions |

4 | Middle Office System | "Middle office business" is a very broad concept, typically defined as business transactions between banks and external systems. Examples include third-party payments, collection and payment services, central finance, bank-insurance connectivity, customs trade systems, fund pooling, and inter-city bill exchange, among others |

5 | Shanghai Clearing House | Ordinary remittance, transfer credit, password remittance out, password remittance withdrawal, password remittance return, return application, remittance return, password remittance return, inquiry, reply to inquiry, cancel remittance. |

6 | ATM/VTM Front-end System | Check balance, deposit, re-deposit, withdraw, withdraw reversal, cardless withdrawal, interconnection withdrawal, intra-bank card-to-card transfer, intra-bank card-to-card transfer reversal, account statement inquiry, account information inquiry, change password. |

7 | POS Front-end System | Balance inquiry, purchase, purchase reversal, purchase cancellation, refund, pre-authorization, pre-authorization cancellation, pre-authorization completion, check-in/check-out, key reset, etc. |

8 | The People's Bank of China's Second Generation Payment System | The People's Bank of China's second-generation payment system is divided into large-value payment system, small-value payment system, and internet banking interconnection. The operations include: credit submission, debit submission, reversal transaction, core query transaction, submission of abnormal transaction query, submission of return, credit submission, debit submission, return submission, inquiry submission, posting submission, session inquiry, etc. |

9 | Counter system | The counter terminal system is divided into high-counter and low-counter services. High-counter services include deposits, withdrawals, transfers, inquiries, etc., while low-counter services include financial management, funds, etc. |

10 | Supply chain system | Internal management queries customer information, B2B data requests, adding, modifying, and deleting credit institutions, credit institution information inquiries, and online banking initiating SCF transaction details. |

11 | International Business System | Establishment of comprehensive service for loan agreements, creation of letter of guarantee agreement services, deletion of letter of guarantee agreement services, account information inquiry, establishment of letter of credit registration service, spot inquiry transaction query, settlement of letter of credit registration service, comprehensive trial calculation allocation service, electronic channel customer account information browsing |

12 | Check image system | Teller sign-in for the bill system, inquiry of bill business account information, manual status synchronization, reconciliation of the bill system's general ledger, reconciliation of bill system details, registration of check withdrawal information, registration of check deposit information, and handling of bill business corrections. |

13 | Credit card system | Establishment of corporate customer information, modification of corporate customer information, establishment of individual customer information, inquiry of individual customer information, user identity authentication check, unified reversal entry. |

14 | Savings Bonds System | Opening of national debt custody accounts, closure of national debt custody accounts, subscription for savings bonds, early redemption of savings bonds, inquiry of specified national debt transaction history, unpacking of multiple queries for national debt codes, inquiry of account opening information, self-service pledged loan inquiry, verification of national debt information inquiry, application for self-service pledged loan, debt conversion for self-service pledged loan, loan settlement for self-service pledged loan, etc. |