- Financial Investment Banking System Software

- Third-party payment solution

- Bank Electronic Channel Access Solution

- Xinda Payment Platform

- Xinda Membership System

- Xinda Payment terminal

- Fingerprint Payment System

- Near Field Communication (NFC) Payment System

【MCDS】Financial Investment Banking System Software

Overview

Looking ahead to the development of China's national economy, there is still a long period of expectation for maintaining rapid and sustained stable growth in the future, which will provide a continuous driving force for the development of China's capital market. According to the plans of the Shanghai Stock Exchange, efforts will be made to have more than 1,200 listed companies by the end of 2015. The goal of the Shenzhen Stock Exchange is that during the "Twelfth Five-Year Plan" period, the ChiNext board will add an average of more than 150 companies annually, and by the end of the "Twelfth Five-Year Plan" period, there will be over 1,200 listed companies on the ChiNext board; the Growth Enterprise Market (GEM) will add more than 200 companies annually, and by the end of the "Twelfth Five-Year Plan" period, there will be 1,000 listed companies on the GEM.

This means that the investment banking business of various securities firms will enter a period of explosive growth, and many companies with potential for listing will leverage the rapid development of the securities market to achieve listing. How to establish more effective business processes, improve the success rate of investment banking business, and enhance business efficiency will become issues that various securities firms must face. Traditional management models can no longer meet the full-process management requirements of an investment banking project, and often face various problems.

Based on years of industry experience and rich project accumulation, Beijing HopeTree Education Technology Co., Ltd. has designed and developed the Investment Banking Management Platform (referred to as FIIS@BWPS), which can effectively help securities firms realize the full-process management of investment banking business, including contracting, underwriting, and issuance. The system adopts a B/S architecture, realizing the electronic management of investment banking business, documents, progress, etc., supporting decentralized operations of project teams, effectively improving the accuracy of project management and the efficiency of collaboration, and enhancing project profitability.

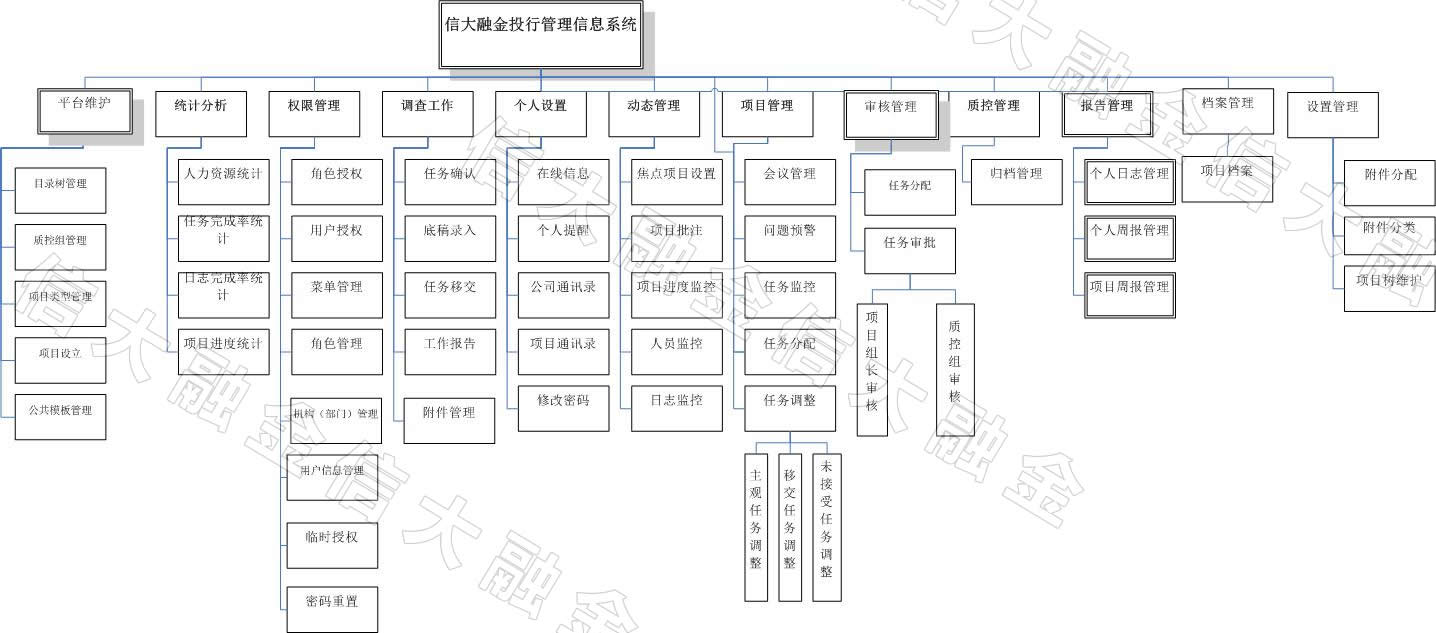

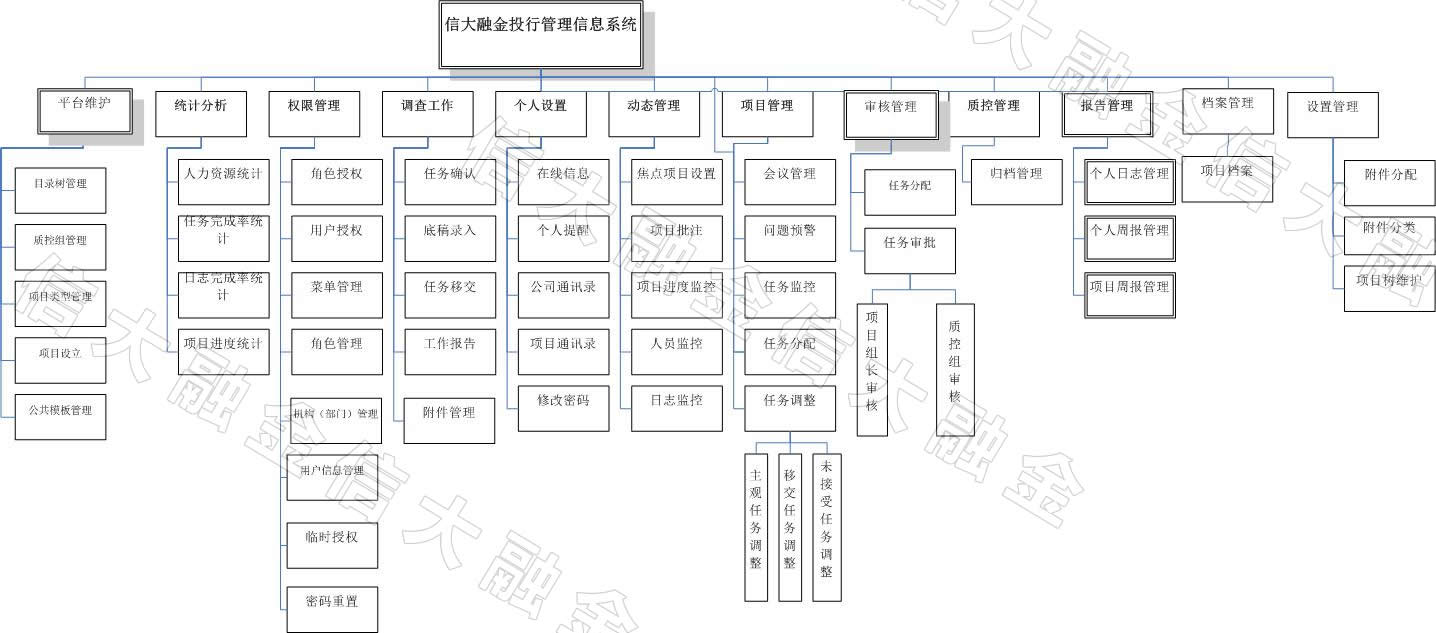

Logical Structure

Introduction to Functions

Advantages:

1. The overall architecture design adopts the "lean core, extensive periphery" design concept, allowing flexible expansion of financial business functions.

2. Designed from transaction-oriented to service-oriented.

3. The simulated core system adopts a dual-core design, namely: accounting core and service core.

4. Flexible interface design, supporting rapid and flexible integration with various financial systems.

5. All types of account transaction fees within the system are automatically completed by the system.

6. Supports peripheral business systems with small granularity (such as off-site clearing, on-site clearing, media demonstration terminals, queue machines, card swipers, PIN pads, passbook/bill printing support systems, daily account settlement sheets/reconciliation sheets/report printing support systems, etc.).

7. Secure design, utilizing mature permission management and authorization management on the business side, and employing a unified Key Management Platform and Dynamic Password System on the technical side.

8. From the customer's perspective, it can achieve "zero maintenance, zero upgrade, zero intervention, zero operation."

9. Truly capable of supporting 24/7 community finance with multiple business functions, possessing business advantages that ordinary self-service finance cannot compare with.

10. The entire system architecture adopts business processes and technology implementations that are completely consistent with commercial finance, enabling 100% integration into existing commercial finance systems.

Third-party payment solution

Bank Electronic Channel Access Solution

Xinda Payment Platform

Xinda Membership System

Xinda Payment terminal

Fingerprint Payment System

Near Field Communication (NFC) Payment System