Xinda Finance【ESB Enterprise Service Bus】

Xinda Finance【ESB Enterprise Service Bus】

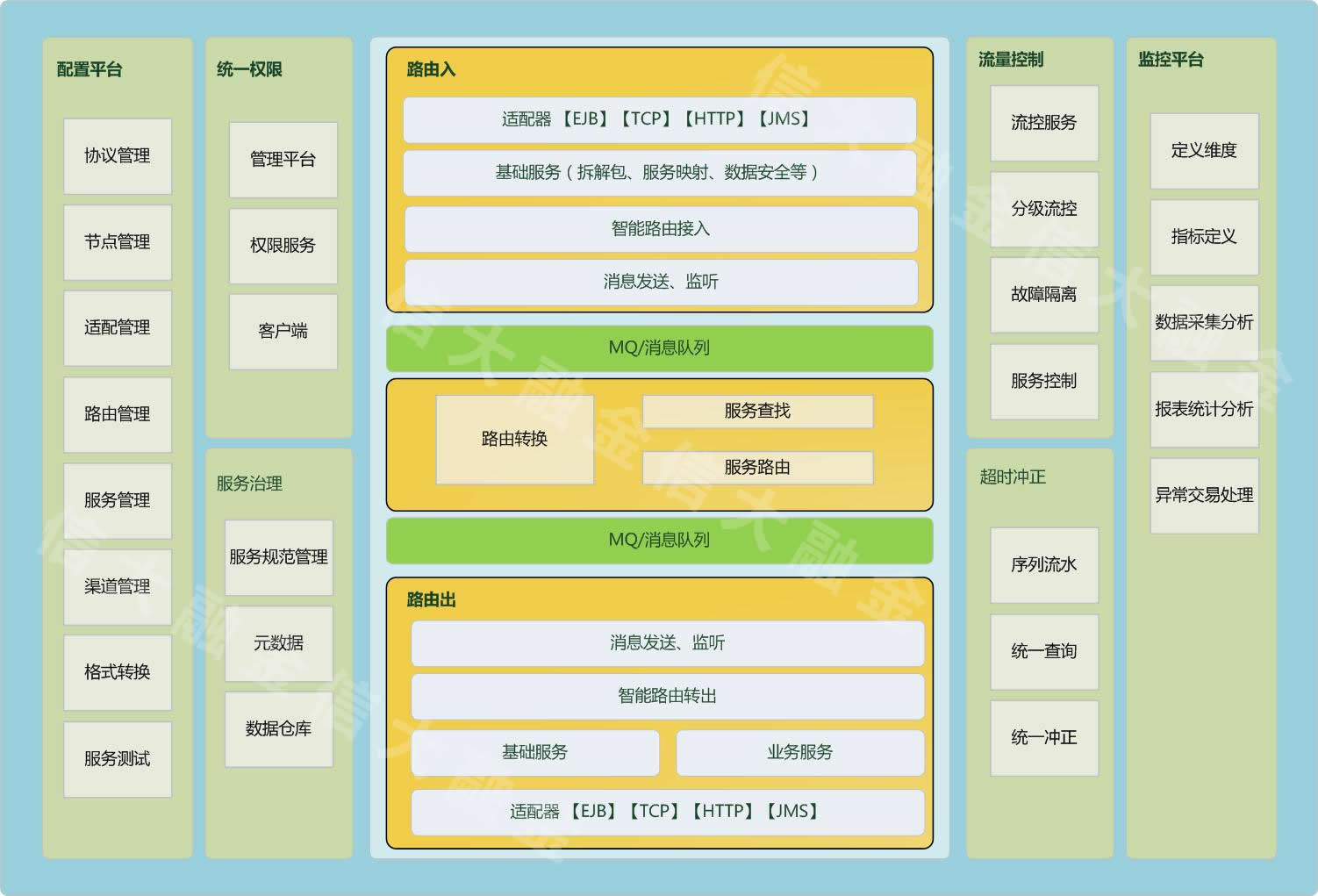

By constructing the ESB platform, it enables the establishment of a standardized and normalized information superhighway among all banking application systems, which is currently the most mainstream solution for the overall IT architecture construction in commercial banks. ESB emphasizes the concept of "Service," highlighting the "S" in its abbreviation. It decomposes all banking business applications into a group of banking services, then defines standardized and procedural service specifications through methods that meet the needs of banking business development and industry standards. Each service in the service specification has a clear business meaning, with defined input and output, and a globally unique service interface. All systems can complete customer business logic processing by calling this service. Under the new architectural framework, ESB becomes the central node connecting all IT systems of the entire bank. The security, stability, and efficiency of the ESB platform will greatly influence the operation of all systems across the bank. A well-designed ESB platform can significantly enhance the operational level of all IT systems across the bank. Through ESB project construction, the IT system resources of commercial banks are integrated, and a multi-layered, line-based, loosely coupled system architecture is established.

ESB is analogous to the "expressway" in real life, connecting the head office, branches, and outlets, serving as the main artery of banking operations. The construction of ESB greatly enhances the overall capability of commercial bank IT systems

1.The future path for process banking, branch transformation, and internet banking development. Currently, ESB has become the most mainstream choice for commercial bank IT architecture construction, serving as a critical technological support for commercial banks to respond to rapid market changes.

2.Facilitates the introduction of innovative banking services. In the face of fierce competition, trends such as interest rate liberalization, internet finance, third-party payments, and diversified operations necessitate that banks establish agile IT architectures capable of responding rapidly. Leveraging the mature system integration capabilities and service composition functionality of ESB, banks can combine a greater variety of services to meet the needs of innovation and diversified operations.

3.Facilitates comprehensive improvement in the technological management level and capabilities of banks. According to reports from Forrester Research, ESB integrates existing and newly built systems, processes, and services of commercial banks, enhancing flexibility to promote development and strengthen control over critical resources, thereby helping enterprises realize the value of SOA.