Xinda Financial Bank Product Architecture Launch

With the comprehensive opening of China's financial industry, competition pressure from global financial markets, diverse customer demands for banking products, increasingly standardized and stringent regulatory requirements, and the rapid development of IT technology, Chinese commercial banks are facing unprecedented new challenges, making transformation imperative! In this process, the core business systems of banks are facing the immediate test brought about by changes in the banking survival environment. The construction of a new generation of core business systems aligned with international standards has become the fulcrum for the successful transformation of banks. Many domestic banks have chosen to comprehensively introduce international core business systems to enhance their core competitiveness. They have also realized that a reasonable, flexible, and loosely coupled IT application architecture is crucial for the overall efficiency of banking IT applications.

As a pioneer and leader in the introduction of international banking core business systems, Beijing Xinda Financial Education Technology Co., Ltd. (hereinafter referred to as "Xinda Financial") has taken the lead in the localization of international banking core business systems. From undertaking the construction of the core business system project for the China Development Bank in 2012 to collaborating with East Asia Bank and Jinan Commercial Bank to build a new international banking core business system, Xinda Financial has been on the road to helping the Chinese banking industry build international core business systems for over a decade. Combining its own years of experience in bank IT system construction with the best practices in the development of bank IT both domestically and internationally, Xinda Financial has summarized and refined the modern IT application architecture for BankingWays 3.0.

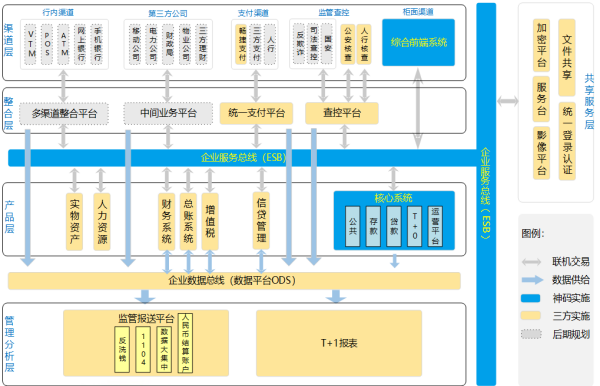

BankingWays 3.0 is a modern, advanced, and flexible IT application panorama for banks, representing a comprehensive, internationally aligned framework solution for the financial industry. It integrates the best practices of international financial IT development with the experience of Xinda Financial's over twenty years in local financial services. The design philosophy reflects Service-Oriented Architecture (SOA), adhering to open and loosely coupled design principles. The application system's functionality distribution is carefully planned, covering the banking channel layer, integration layer, product layer, and management layer. Simultaneously, it outlines two foundational platforms for application integration and data integration, along with a series of integration and integration standards. This approach enables the sharing of banking services and information.

Xinda Financial's BankingWays 3.0 entire application architecture is logically divided into the following levels:

Channel Marketing Layer: In multiple forms, it provides customers with a consistent banking experience and comprehensive services through various channels, including counters, online banking, telephone banking, etc. The 'Multichannel Access' in the application architecture service channel layer is designed to address the transformation of branches, centralized backend operations, expansion of self-service equipment and low-counter service systems, realization of low-counter customer service and wealth portals, electronic channel integration, integrated signing, unified interfaces with third parties and products, and other requirements. This design has been adopted by some global and national banks both domestically and internationally, resulting in a significant improvement in customer service capabilities after implementation.

Enterprise Information Layer: The Customer Marketing Layer, from the perspective of the bank's overall business services and products, provides unified customer relationship management and market marketing management. It also integrates the bank's proprietary products and third-party products to offer personalized financial advisory services to customers. Additionally, it provides cash management and financial supply chain services tailored for corporate clients.

Business Service Layer: This serves as the financial product service center and product innovation hub for the bank, encompassing multiple product production systems such as bank deposits, debit cards, loans, payments, and trade financing, providing external services. As the focus of banking business product development shifts from accounting calculation towards business departments, the application architecture design of the business product processing layer needs to enhance considerations in the standardization of business product processes and information integration. Particularly, it requires meeting the streamlined processing needs of front, middle, and back-office functions for credit, fund, and letter of credit businesses, enhancing business processing efficiency, and ensuring the consistency of business information. In terms of accounting calculation, a unified internal settlement function can be employed to ensure consistency in accounting calculations across products and various business branches.

Intelligent Control Layer: With the goal of assisting banks in achieving digital operations and management, this layer focuses on addressing issues related to bank financial management, risk control, performance assessment, and meeting regulatory requirements.

In general, the overall application architecture of BankingWays 3.0 is designed to cater to business line specialization and channel diversification. It takes into account comprehensive support for end-to-end business processes, effectively addressing the dynamic and flexible needs of rapidly changing banking processes.

According to industry experts, facing competition pressure from the financial market, diversified customer demands for banking products, increasingly standardized and stringent regulatory requirements, and the rapid development of IT technology, the transformation of domestic commercial banks has become imperative. Achieving management innovation, technological innovation, rapid innovation of financial products, and service innovation in the financial industry have become the major trends for the future. In this context, the BankingWays 3.0 application architecture facilitates the transformation of the banking business model. Shifting from the traditional business and product-centric model to a new customer-centric, marketing-oriented process banking business model, it ultimately helps domestic banking financial systems move towards internationalization and sophistication.