- Multi-Industry Xinda Payment System

- Mobile Application Payment Platform

- The Cloud-based Recognition System

- BW Handheld Payment Pass

- BW Handheld Payment Pass

- BW Transaction Terminal

- Bank Transaction Volume System

- High-speed scanner imaging products

- Financial Data Center Technical Solution

- Contract Document Management System

- The iBank Mobile Payment System

- Credit Information Access Management System

- The Currency Serial Number Management System

【MCDS】Multi-Industry Xinda Payment System

Overview

With the progress of the times, people's lifestyles are gradually changing, influenced by factors such as mobile phones, the internet, e-commerce, and even our payment methods. Today, third-party payment tools such as online banking and mobile wallets have quietly been changing our lives, while also containing enormous business opportunities. The core business of China's third-party payment market is the online payment market, which entered an accelerated development stage in 2004 and experienced explosive growth in 2008 and 2009, especially with the introduction of the "Measures for the Administration of Payment Services by Non-financial Institutions" and its implementation rules (draft for comments) by the People's Bank of China in 2010. With this, the third-party payment industry ended its initial growth phase and was formally incorporated into the national regulatory system, gaining legitimate status. In the future, the third-party payment industry will face a pattern of high concentration and differentiation advantages, ushering in breakthroughs in profit models.

In such an environment, Beijing Xinda Financial Education Technology Co., Ltd. has independently developed the MCDS (Multi-industry Xinda Payment System), providing powerful technical support and industry solutions for companies and institutions committed to sharing the feast of the third-party payment industry.

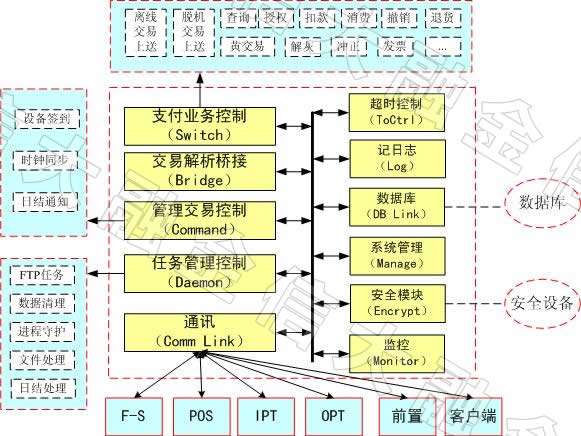

logical structure

Function Overview

The MCDS Multi-Industry Xinda Payment System comprises 9 major functional modules, each of which is further subdivided into various specific system business functions.

1. Online Payment Processing Module

This module is primarily used for processing online payment transactions, including functions such as pre-authorization, deduction, consumption, reserve balance inquiry, yellow transaction upload, refund, invoice printing, online gray resolution, offline transaction upload, etc.

2. Offline Payment Processing Module

This module is mainly used for processing offline payment transactions, including functions such as offline payment data acquisition, offline payment data processing, offline payment data upload, etc.

3. Transaction General Module

This module serves as a general transaction module, including functions such as card information verification, marketing calculation, balance checking, points consumption, etc.

4. Device Management Module

This module is used for managing devices, including functions such as system initialization, system operation monitoring and management, device sign-in management, clock synchronization management, payment device management, etc.

5. Data Management Module

This module is used for classifying and managing data information, including functions such as blacklisted data management, whitelisted data management, yellow-listed data management, gray-listed data management, master data management, marketing rule data management, version data management, etc.

6. Daily Settlement Management Module

This module is used for processing system daily settlements, including functions such as daily settlement response, date switching, daily transaction summary, daily detail consolidation, daily error data consolidation, system reconciliation, etc.

7. Query Module

This module is used for handling query businesses, including functions such as data query, transaction query, device query, etc.

8. Parameter Setting Module

This module is used for parameter setting, including functions such as communication parameter setting, business parameter setting, system parameter setting, etc.

9. System General Module

This module integrates system general underlying functions, including functions such as message assembly and bridging, communication functions, storage forwarding functions, data cleaning functions, file processing functions, security processing functions, process guarding functions, etc.

Advantages and Features

1. The system supports 7*24-hour uninterrupted operation.

2. The system has high maintainability.

3. The system exhibits high stability and reliability.

4. The system offers high flexibility and configurability.

5. The system allows for convenient and rapid secondary development.

6. The system ensures highly secure encrypted transmission of data.

7. The system's business is highly flexible in deployment, addition, and deletion, demonstrating high business scalability.

Mobile Application Payment Platform

The Cloud-based Recognition System

BW Handheld Payment Pass

BW Handheld Payment Pass

BW Transaction Terminal

Bank Transaction Volume System

High-speed scanner imaging products

Financial Data Center Technical Solution

Contract Document Management System

The iBank Mobile Payment System

Credit Information Access Management System

The Currency Serial Number Management System