- Bank Comprehensive Front-end System

- Bank Middle Office System

- Bank Credit Management System

- Bank Credit Card System

- Bank Telephone Banking System

- Bank Multimedia Self-Service Terminal Front-end System Software

- Bank IC Card System

- The Bank Electronic Cash Platform System

- Bank UnionPay Front-end System

- The "MCDS" Counter Service Front-end System

- The "MCDS" refers to the Bank's Fixed Telephone Banking System

- Bank ATM/CDM/VTM Front-end System Software Summary

- Bank Mobile Banking System Software

- Specialized Business Platform

- Bank POS Terminal Management Front-end System Software Overview

- Multi-Industry, Multi-Application, Multi-Channel POS System Software Overview

- Banking Business Laboratory

- BW Regulatory Reporting Platform

- BW Monitoring and Management Platform

- The BW Teller Interaction System

- BW Mobile Issuing Terminal

- Customized Counter Exchange Platform

- Customized counter small amount processing terminal

- OCR Electronic Recognition and Verification System

- Banking Core Business System

- Cash Payment Receipt Recognition Management System

- Banking Business Analysis System

- Multi-channel Management Platform

- Enterprise Service Bus (ESB) System

- VTM Front-end System

- The People's Bank of China's second-generation payment system

- The same-city settlement system

- Margin System

- Financial and Tax Treasury Bank System

- Financial and Tax Treasury Bank System

- Treasury Authorized Payment System

- The Fiscal Non-Tax System (Local)

- The online verification system.

- Prepaid Card Reserve Fund Supervision System

- Funds Collection System (Personal/Enterprise)

- The People's Bank of China Treasury Centralized Payment System

- The physical precious metals trading system

- Tax custody system

- Financial Authorization Payment System (Central)

- The Fiscal Non-tax System (Central)

- Alipay Fund Supervision System

- "Yinbao Tong" System

- Trade System

- Proxy Payment Service System

- Western Union Money Transfer System

- Funds Supervision System

- One Card Pass System

- The ETC system

- Social Security System

- The Housing Provident Fund System

【MCDS】Bank Comprehensive Front-end System

Overview

In recent years, with the continuous increase in banking business demands, the burden on banking core systems has significantly increased. As a result, major banks have proposed the concept of "front-end heavy, core slim," aiming to detach business logic from the core systems to alleviate the burden on core business systems. In this context, Beijing Xinda Financial Education Technology Co., Ltd. has developed a new generation of MCDS (Multi-channel Comprehensive Front-end Banking System), designed to integrate the business logic processing of bank transactions across multiple channels.

Xinda Financial's [MCDS] Bank Integrated Front-end System is a 100% real-time business processing platform tailored specifically for the financial industry. It adheres to open standards, closely follows various specifications and standard requirements of the financial industry, and supports the latest standards such as UnionPay 2.1, PBOC 2.0, ISO 20022, ANSI 98, 3DES, etc. It establishes a "customer-centric" secure and stable operation system under the framework of "small core, large periphery," serving as a business integration platform. It realizes various complementary integration solutions such as "channel integration, business integration, information integration, and application integration." It provides an integrated development environment with comprehensive network protocol and middleware support, enabling rapid implementation and deployment, as well as quick integration with existing commercial banking systems. It allows for swift, simple, and effective secondary development according to different financial business requirements.

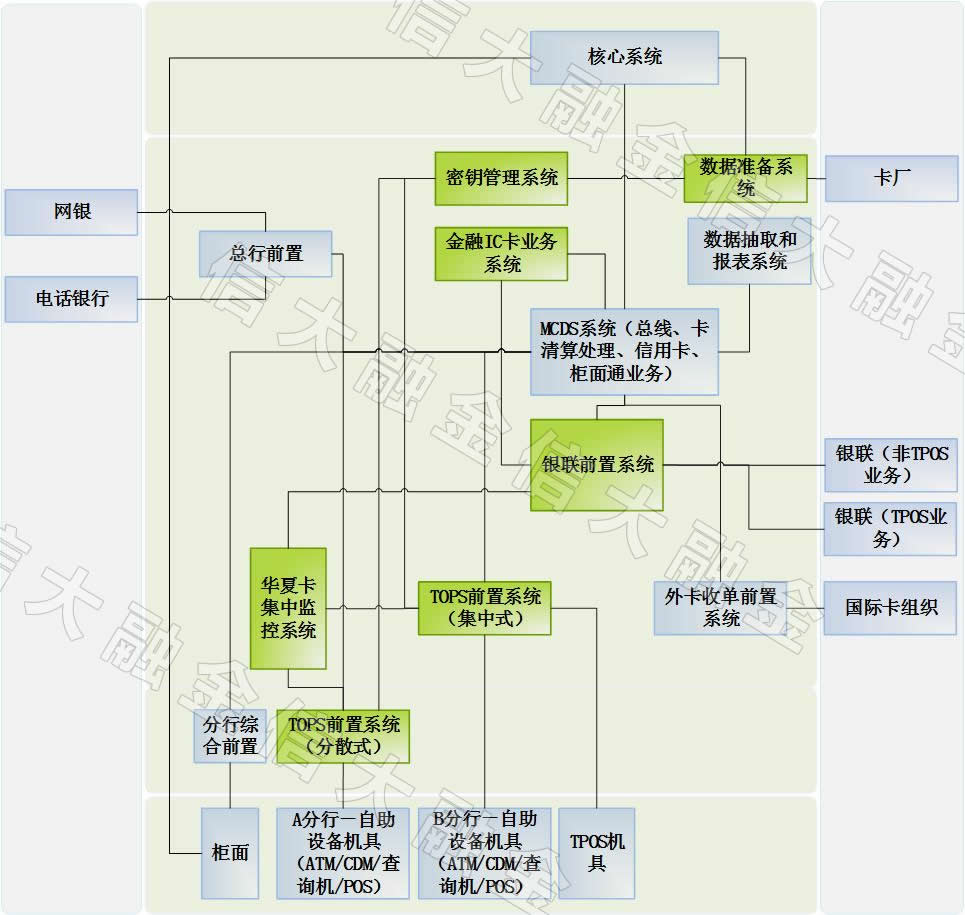

Logical Structure

Function Overview

Xinda Financial's [MCDS] comprehensive prepositioning system for banks is divided into three parts: the Application Service Access Subsystem, the Application Service Distribution Subsystem, and the Application Service Process Control Subsystem. Based on this, it can achieve the business functions of multiple bank systems such as finance and taxation, intermediary business, second-generation payment, ATMP end, UnionPay front-end, and precious metals systems, and supports access from various terminal channels such as counter systems, online banking systems, ATM systems, POS terminals, and self-service terminals.

1.Application Service Access Subsystem

Responsible for monitoring transaction request communication messages from various terminal devices, peripheral systems, or external banking systems in various ways, and forwarding the received messages to the Application Service Distribution subsystem after uniformly repackaging them based on the initiator of the transaction

2. Application Service Distribution Subsystem

The Application Service Distribution Subsystem receives transaction messages from CCS, parses and splits them, determines the subsequent processing system, and invokes the Application Service Process Control Subsystem for transaction flow processing.

3. Application Service Process Control Subsystem

The Application Service Distribution subsystem receives transaction messages from CCS, parses and splits them, determines the subsequent processing system, and invokes the Application Service Process Control subsystem for transaction flow processing.

Advantages and characteristics

1.Advancement

The architecture is reasonable, with distributed access, centralized processing, decentralized business management, and mature system platform technology employed.

2. Flexibility and configurability

Adaptable, flexible in configuration, it addresses complex issues such as multiple access channels, diverse business types, and high requirements for management and monitoring. It effectively controls and manages configured resources, maintaining order amidst activity.

3. Comprehensive manageability

Provide a unified management operating environment, offering central business management functions such as daily maintenance operations, account processing, batch business processing, and query services. All operations can be effectively tracked and monitored.

4. Excellent stability

The system demonstrates extremely high stability and supports uninterrupted operation 24/7.

5. Efficient processing capability

Supports real-time and non-real-time, single and batch transactions initiated through various channels such as front-end counters, banking peripherals, external systems, etc., providing banks with the processing capability to handle high transaction pressures while maintaining transaction processing consistency.

6. Good scalability

The system features a well-designed modular structure, which minimizes the impact on the original system during maintenance, upgrades, and other functionality expansions. This design simplifies and standardizes system upgrades and maintenance, reducing the cost of promoting the system to a minimum.

7. Reliable security

The security of the system encompasses two aspects. On the one hand, due to the system's interaction with multiple external systems for transactions, there are security concerns regarding the system itself and the security of online transaction data. To address this, the system has established corresponding security mechanisms and a communication security assurance system. On the other hand, in the process of system development and usage, it inevitably involves internal developers, system administrators, and general operators. Therefore, the system has implemented an effective system user authorization and tracking control system to prevent internal data security issues arising from improper actions by personnel.

8. Secondary development capability

The design of the target system is an open system that can adapt to the development of business. Through traditional development methods, the application-level functionalities of the system can be expanded to enhance its adaptability.

9. System Security Capability

The system has the capability to respond to abnormal or fault incidents. It implements fault protection functions at the software level to minimize losses caused by faults as much as possible, thereby enhancing the system's recovery capability and speed.

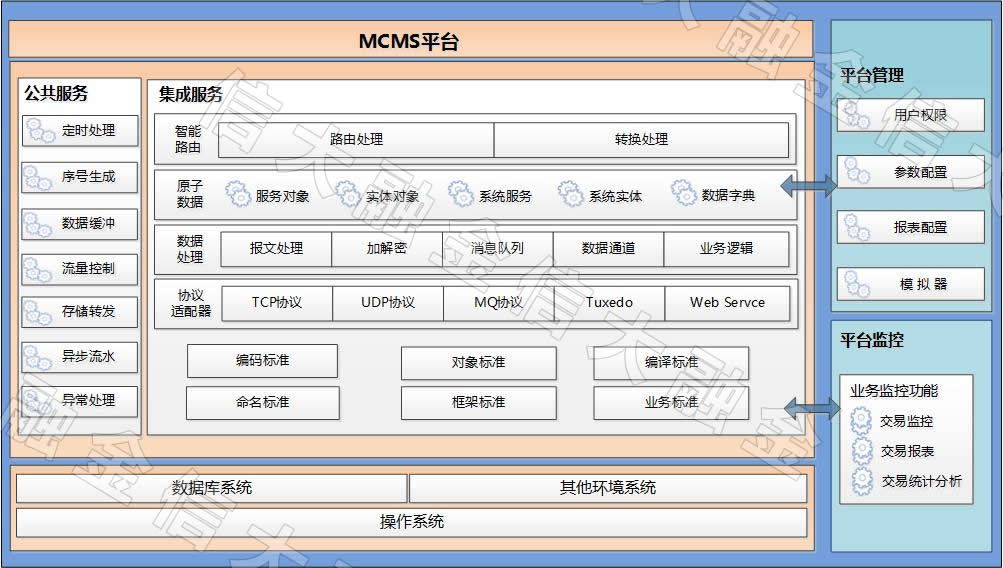

【MCDS】Bank Middle Office System

Overview

In recent years, competition in the domestic banking industry has become increasingly fierce. The profits generated by traditional commercial banking operations have been shrinking, prompting commercial banks to seek and expand profit margins by focusing on distinctive services. Overseas, distinctive services offered by commercial banks have matured considerably. In countries like the United States, Japan, and the United Kingdom, revenue from distinctive services accounts for around 40% of total income. However, the development of distinctive services in Chinese commercial banks is not as satisfactory. Distinctive services in Chinese commercial banks are characterized by small scale and limited variety, which are major issues hindering their development. Additionally, there is considerable low-end competition within the industry, greatly impeding the rapid growth of distinctive services. The prevalence of product development imitation and a lack of innovation further exacerbate these challenges. Consequently, the rapid development of unique financial products has become a pressing issue facing financial enterprises today.

solutions and services. After years of practice and exploration in the financial industry by the company's employees, and based on the analysis and summary of market demand in the financial industry, a new generation of online transaction processing platform was developed and completed in September 2013. It can achieve real-time business transaction processing and provide users with agile development interfaces, allowing users to carry out rapid, simple, and effective secondary development according to different financial business needs, and quickly develop software that meets customer requirements.

"Logical structure"

"Feature Introduction"

[MCDS] The bank's middle-office system has the following four major functional features

1.A 100% real-time transaction processing platform tailored specifically for the financial industry, adhering to open standards and closely following various specifications and standard requirements of the financial industry. It supports the latest standards such as UnionPay 2.1, PBOC 2.0, ISO20022, ANSI98, and 3DES.

2. Establish a "customer-centric" secure and stable operational system, with a business integration platform under the concept of "small core, large periphery".

3. Achieve "channel integration, business integration, information integration, and application integration".

4. Equipped with an integrated development environment, comprehensive network protocol, and middleware support, it enables rapid deployment and seamless integration with existing commercial financial systems.

"Advantages and characteristics"

1. The overall architecture design adopts the concept of "lean core, extensive periphery", enabling flexible expansion of financial business functionalities.

2. Transition from Transaction-oriented to Service-oriented Design

3. The simulated core system adopts a dual-core design, namely: the accounting core and the service core.

4. Flexible interface design supports rapid and flexible integration with various financial systems.

5. Transaction fees for all types of accounts within the system are automatically processed by the system.

6. Supports granular peripheral business systems (such as: off-counter clearing, on-counter clearing, media demonstration terminals, queue machines, card readers, PIN pads, passbook/bill printing support systems, subject daily settlement/daily reconciliation statements/report printing support systems, etc.)

7. Secure design, employing mature permission management and authorization management in business, and utilizing a unified Key Management Platform and Dynamic Password System in technology.】

8. From the customer's perspective, it can achieve "zero maintenance, zero upgrades, zero intervention, zero operations."

9. The entire system architecture adopts business processes and technological implementations that are fully consistent with commercial banking, enabling seamless integration with existing commercial banking systems.

【MCDS】Bank Credit Management System

Overview

In recent years, with the rapid development of business, numerous commercial banks have put forward the development concept of customer-centricity and providing customers with higher-quality financial services based on their own development situations. To adapt to the changing business landscape, the information technology construction of commercial banks has also transitioned from being technology-centric to being service-centric. Foreign core banking systems, leveraging their advanced concepts and mature products, have gradually entered the field of vision of domestic commercial banks. However, in the process of constructing foreign core banking systems, some issues have been exposed, with a prominent one being that under the existing architecture of banks, foreign core banking systems cannot find effective integration solutions when interfacing with numerous peripheral business systems with domestic characteristics, thereby failing to meet all business requirements.

Based on the issues faced by commercial banks in the construction of new core business systems, Beijing Xinda Financial Education Technology Co., Ltd. has developed the MCDS (Master Credit Data System) banking credit management system. Built upon this foundation, the overall banking application system can effectively reduce the complexity of application system integration, achieve effective reuse of various service resources, and enhance the bank's business service capabilities.

Logical structure

Overview of Functions

1. The overall architecture design adopts the "lean core, extensive periphery" design concept, enabling flexible expansion of financial business functions.

2. Transitioning from transaction-oriented to service-oriented design, the simulated core system employs a dual-core design: the accounting core and the service core. Flexible interface design supports rapid and flexible integration with various financial systems. All transaction fees for all types of accounts within the system are automatically completed by the system.

3. Supports peripheral business systems with fine granularity (e.g., off-counter clearing, on-counter clearing, media demonstration terminals, queuing machines, card readers, pin pads, passbook/note printing support systems, account day-end statements/reconciliation statements/report printing support systems, etc.).

4. Security design incorporates mature permission management and authorization management on the business side, and unified key management platform and dynamic password system on the technical side.

5. From the customer perspective, it achieves "zero maintenance, zero upgrades, zero intervention, zero operations."

6. Truly supports 24/7 community finance with various business functions, possessing business advantages that ordinary ATM/CDM self-service finance cannot match.

7.The entire system architecture adopts business processes and technological implementations fully consistent with commercial finance, enabling 100% integration with existing commercial finance systems.

Advantages and features

1. Advancement:

The overall technical solution of the system adopts advanced architecture in the industry, conforming to the trend of information technology development and the requirements of China's commercial banking IT development plan. The MCMS system utilizes mature technologies that comply with international and domestic standards for hardware and software, with mature and stable software design principles.

2. Security and Reliability:

Financial systems involve highly centralized data and processing, requiring application systems to be built on mature and stable hardware and application software. This is achieved through comprehensive backup and recovery strategies, robust security control mechanisms, reliable operation management monitoring, and fault handling measures to ensure the stable and secure operation of the system.

3. Scalability:

During system construction, there should be a high degree of scalability in both hardware configuration and software design, allowing for future business expansion and providing an expansion foundation. As the foundation platform for community finance, the system should fully consider the convenience of interconnection with other commercial banking systems.

4. Forward-looking:

In the process of system construction, considerations should encompass future business development and management needs, facilitating the expansion and support of new business and new requirements. Additionally, there should be full consideration of the effective integration of the software architecture with other platforms and systems in IT planning to meet the needs of future community finance business development.

5. Maintainability:

The system's maintainability determines its operating costs. It should have convenient and flexible maintenance management methods. System design should fully consider operational monitoring, providing convenient and flexible management tools.

6. Economic Efficiency:

System construction should consider aspects such as data storage, transmission, disaster recovery backup, and network information security, while making rational use of existing network and technological resources.

【MCDS】Bank Credit Card System

Summary

【MCDS】Bank Credit Card System is a set of system software products independently developed by Beijing Xinda Financial Education Technology Co., Ltd., covering a series of bank credit card system business functions such as credit card application and cancellation, credit card deposit and withdrawal, credit card transfer, and credit card repayment. The system adopts an advanced platform architecture, reliable technology system, and efficient and reasonable industry solutions, forming a secure, reliable, efficient, and stable bank credit card system.

Logical structure

Feature Introduction

The MCDS (Multi-Channel Credit Card System), independently developed by Beijing Xinda Financial Education Technology Co., Ltd., covers almost all aspects of the bank's credit card system, enabling functionalities such as credit card application and cancellation, credit card deposits and withdrawals, credit card transfers, and credit card repayments.

1. Credit Card Cash Withdrawal:

Used for withdrawing cash from the bank's credit card counter for both cash advances and overpayment. RMB supports overpayment and overdraft withdrawals, while USD supports overpayment withdrawals.

2. Withdrawal Reversal

Used for the reversal of credit card cash withdrawal transactions, supported only for transactions made on the same day.

3. Credit Card Deposit:

funds. This transaction does not verify the card status and can continue to deposit cash unless the card is officially closed.

4. Credit Card Deposit Reversal:

Used for credit cardholders to deposit cash at the counter by swiping the card, making cardless deposits, or returning overdraft Used to reverse credit card deposit transactions, only supporting transactions made on the same day.

5. Renminbi Payment in Foreign Currency:

Customers can use Renminbi cash to purchase foreign currency to repay outstanding balances in foreign currency accounts held with the bank. The purchase of foreign currency must comply with the relevant regulations of the State Administration of Foreign Exchange.

6. Reversal of Renminbi Payment in Foreign Currency:、

The reversal of transactions involving Renminbi payment in foreign currency is only supported for transactions conducted on the same day.

7. Debit Card to Credit Card Transfer

This transaction enables the transfer of funds from a regular bank debit card to deposit into a Huaxia credit card. This transaction only supports transfers in Chinese Renminbi (RMB).

8. Debit Card to Credit Card Reversal

Used for reversing debit card to credit card transactions, limited to transactions made on the current day.

9. Automatic Repayment Enrollment:

Establish an automatic repayment authorization between the bank's other settlement accounts and the bank's credit cards. After enrollment in automatic repayment, it can provide two automatic repayment methods: automatic repayment of RMB debt to RMB accounts and automatic forex purchase repayment of foreign currency debt.

10. Contract Information Inquiry:

Inquire about the automatic repayment authorization relationship between the credit card and other settlement accounts of the bank.

11. Contract Information Deletion:

To delete the automatic repayment authorization relationship between the credit card and other settlement accounts of the bank.

12. Account Settlement after Credit Card Cancellation:

Used for counter credit card cancellation settlement transactions. After the cardholder's cancellation application has been pending for a fixed number of days (controlled by the issuing system), they can go to the counter to settle the overpayment in the credit card account, withdraw the overpayment from their account, and complete the formal cancellation process.

13. Change Password:

Credit card holders can modify their transaction password at bank branch counters through this transaction.

14. Reset Password:

If the cardholder exceeds the limit of consecutive incorrect password attempts or forgets the password, they can reset the password and reset the number of incorrect password attempts through this transaction.

15. Credit Card User Information Inquiry:

Inquire about credit card details such as credit limit, installment payment limit, available credit limit, cash withdrawal limit, RMB balance, USD balance, automatic repayment account, automatic debit repayment method, account holder's name, etc.

16. Credit Card Statement Inquiry:

Query the previous billing balance and the current minimum payment amount for the credit card.

17. Remittance Transfer Repayment:

Enable direct transfer of the remittance amount from other banks or remote locations into the credit card account upon its receipt into the bank's system. This transaction supports only RMB transactions.

18. Remittance Transfer Repayment Cancellation:

Used for canceling remittance transfer repayment transactions, limited to transactions made on the same day.

19. Large-Sum Credit Card Remittance:

The credit card issuing system generates a "large-sum batch remittance file" based on the signing records after batch processing every day, which is sent to CCFS. CCFS processes each transaction in the "large-sum batch remittance file" for remittance.

20. Credit Card Batch Enrollment Processing:

based on the enrollment records after daily batch processing, which is then sent to CCFS for batch enrollment processing.

21. Credit Card Batch Enrollment Result File Transmission:

The signed result file is sent to the credit card front-end processor according to the input processing date.

22. Credit Card Batch Automatic Deduction Repayment Processing:

After daily batch processing, the credit card issuing system generates a "deduction repayment file" based on the enrollment records, which is then sent to CCFS. CCFS converts the "deduction repayment file" into a file format for batch account posting by the bank and places it in a specified directory.

23. Credit Card Batch Automatic Deduction Repayment Result File Transmission:

The system reads the batch account posting result file transmitted by the core system on the input processing date, converts it into a batch automatic deduction repayment result file format agreed upon with the credit card front-end, generates an MD5 verification file, and sends both the batch automatic deduction repayment result file and the MD5 file to the credit card front-end processor.

24. Credit Card Batch Forex Repayment Processing:

After the credit card issuing system completes its daily batch processing, it generates a "Forex Repayment File" based on the signing records and sends it to the CCFS. The CCFS then processes batch forex repayments based on the "Forex Repayment File."

25. Generation and Transmission of Credit Card Batch Forex Repayment Result Files:

The system reads the batch posting result files transmitted by the core system on the specified processing date. These files are converted into batch forex repayment result files formatted according to the pre-agreed format for the credit card front-end system. Additionally, an MD5 checksum file is generated and sent along with the batch forex repayment result files to the credit card front-end system.

26. Processing of Credit Card Transaction Detail Files:

The system reads the credit card transaction detail files transmitted by the bank's core system on the specified processing date. These files are then converted into the pre-agreed format for the credit card front-end system. Simultaneously, an MD5 checksum file is generated. The transaction detail files, summary files, and MD5 files are sent to the credit card front-end system.

27. Credit Card Business Clearing:

The CCFS reads the credit card clearing register and processes credit card clearing accounting entries.

Advantages and Features

1. The system supports uninterrupted operation 24/7.

2. The system is highly maintainable.

3. The system exhibits high stability and reliability.

4. The system is highly flexible and configurable.

5. The system allows for convenient and rapid secondary development.

6. The system ensures high information security through encrypted data transmission.

7. The system's business operations are highly flexible, scalable, and removable, exhibiting a high degree of business extensibility.

8. The overall technical solution of the system adopts an advanced industry architecture, with mature and stable software design principles, demonstrating advanced characteristics.

9. The system's construction considers future business development with a high degree of foresight.

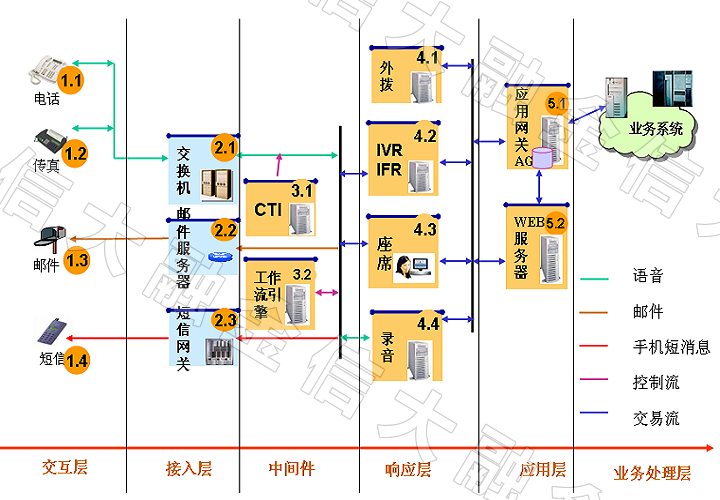

【MCDS】Bank Telephone Banking System

Overview

In recent years, with the rapid development of the Chinese economy, the banking industry has undergone significant changes. While increasingly providing convenience to the general public, banking services, especially financial services, have become indispensable in people's lives. Along with enjoying the convenience brought by banking and financial services, people also have higher expectations for the quality of these services. In order to improve the service and business management level of Beijing Xinda Financial Education Technology Co., Ltd., establish a good service image, and meet various practical needs of the people, major banks are preparing to establish telephone banking systems to better meet the needs of the general public, enhance the level of business services, and thus, the MCDS bank telephone banking system came into being.

With the development and maturity of IT technology and industry, the MCDS bank telephone banking system is no longer just a hotline telephone, but has been endowed with new features: CTI (Computer Telephony Integration) integrates computer networks and communication networks; the introduction of distributed technology allows manual agents to work without being centralized in one place; automatic voice response devices not only largely replace the work of manual agents, but also enable the MCDS bank telephone banking system to operate 24/7 uninterrupted; the revolution of the Internet and communication methods further enables the MCDS bank telephone banking system to handle not only telephone calls but also fax, email, web access, and even internet-based telephone and video conferences. Therefore, today's telephone banking systems far exceed the scope defined in the past, becoming core information technology systems that provide interactive services to customers through various modern communication means.

Logical Structure

Overview of Functions

1. The overall architecture of the Telephone Banking and Customer Service Center system is divided into two parts: the "Voice Access Platform" and the "Application Service Platform." The "Voice Access Platform" provides support for the underlying platform functions of the call center, while the "Application Service Platform" implements application functions such as business applications and system management.

In terms of the overall architecture of the Telephone Banking and Customer Service Center, it can be divided into six layers according to logical structure:

a. Interaction Layer

b. Access Layer

c. Middleware

d. Response Layer

e. Application Layer

f. Business Processing Layer

2. The Interaction Layer and the Access Layer constitute the voice access platform of the Telephone Banking and Customer Service Center; the Middleware, Response Layer, and Application Layer constitute the application service platform of the Telephone Banking and Customer Service Center.

3. The Interaction Layer is the service channel provided by the Telephone Banking and Customer Service Center system to customers. These channels include telephone, fax, SMS, email, internet browser, and messaging.

4. The Access Layer provides access support for service channels, including telephone exchanges (PBX/ACD), internet access (Web/E-mail), and SMS gateways. It, under the control of middleware, delivers customer service requests to the most suitable service resources at the earliest opportunity, ensuring that customers receive rapid and high-quality service.

5. The Middleware is a unique software module of the Telephone Banking and Customer Service Center system, including CTI, message collaboration, and workflow services. The middleware is responsible for coordinating and controlling various modules of the system to provide timely services to customers.

6. The Response Layer is the service window of the Telephone Banking and Customer Service Center system, including agent software, self-service voice response services, outbound services, and recording systems. The recording system, in coordination with the agent software, records conversations between agents and customers.

7. The Application Layer includes WEB application services and application gateways. WEB application services and application gateways are responsible for processing transactional services, implementing business logic, and traffic control, respectively. External interface services provide transaction processing services.

8. The Business Processing Layer consists of the core business systems of China Postal Savings Bank and other auxiliary business systems, responsible for handling various backend transaction businesses.

Advantages and Characteristics:

1. Advancement:

The construction of the telephone banking system should fully consider the adoption of new technologies in the current telephone banking system and the research and development capabilities of product suppliers in their professional fields to ensure that the built system is not only able to meet current requirements but also technologically advanced and compatible with new technologies in the foreseeable system lifespan.

2. Stability:

Reliability and stability are important design principles of the system, and effective measures must be taken to ensure the stable operation of the entire system and provide 24/7 service.

3. Flexibility:

The telephone banking system should provide open standard interfaces, allowing easy connection of Postal Savings Bank's business application systems without being restricted to specific vendors' hardware devices, thus making the system more scalable and flexible.

4. Openness:

The system should have good openness and compatibility, supporting international standard protocols and interface types, providing multiple open application development interfaces, and being able to interconnect with mainstream products in the industry.

5. Security:

The system's security design should consider system platform security, telephone network security, network security, and operational security to ensure secure operation under various conditions.

6. Scalability:

The system should support flexible configuration and combination of hardware and convenient upgrades and updates, with the capacity to meet increasing user volumes.

7. Maintainability:

The system should provide monitoring and control functions for operational situations to ensure normal operation, and offer maintenance interfaces for efficient and effective system maintenance.

8. Manageability:

The system's management system should be efficient, multi-level, and user-friendly, allowing administrators to adjust various software and hardware resources according to business needs.

9. Disaster Recovery:

The system design should consider comprehensive backup strategies and a system recovery system for disaster recovery scenarios.

10. Balance:

The system's platform-based structure and modular business structure ensure that service content and business functions of the Telephone Banking and Customer Service Center system are independent and not mutually restrictive. Additionally, the system should evenly distribute transaction loads across all relevant platform devices and provide efficient operation without bottlenecks.

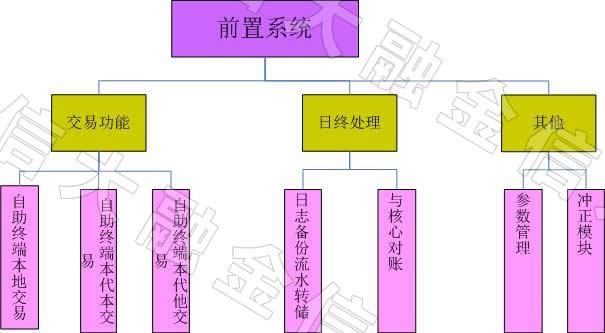

【MCDS】Bank Multimedia Self-Service Terminal Front-end System Software

Overview

In recent years, the bank card business has experienced rapid development and widespread popularity, with 24-hour ATM self-service financial services and POS card swipe consumption bringing a lot of convenience to people's lives and work. Faced with the growing business, existing ATM front-end systems in banks have exposed many problems and drawbacks: the diverse models of self-service devices often lead to difficulties in upgrading applications when new devices are introduced, resulting in high upgrade costs and long cycles; there is a lack of standard management and monitoring tools, with no complete monitoring and alert system, leading to untimely detection and troubleshooting of faults; the success rate of system transactions needs to be improved; there are vulnerabilities in the system's security design, leading to cases of financial crimes through information technology; and there is a lack of multi-level management systems and remote management control tools.

Beijing Xinda Financial Education Technology Co., Ltd. provides a perfect multimedia self-service terminal front-end system solution for commercial banks based on its proprietary MCDS platform. It helps bank customers establish a feature-rich, advanced architecture, excellent performance, high stability, high reliability, and high security bank multimedia self-service terminal front-end system, which is widely used in many commercial banks nationwide.

logical structure

Introduction to Functions

1. Transaction Module Introduction

The transaction processing module is responsible for daily transaction processing. The platform of the transaction processing module is developed based on the BW platform. The implementation methods of communication module, timing module, SAF module, and outbound routing module remain unchanged, while there are changes in the functionality of the inbound routing module and the implementation process of transaction processing. The functionality of the transaction processing process involves reading messages from the inbound routing queue, parsing messages, completing related transaction processing, and then packaging messages according to the message rules of the destination route and writing them into the outbound routing queue.

The transaction processing process handles three types of messages: normal transaction messages, transaction timeout messages sent by the timing process, and transaction reversal and retransmission messages sent by the SAF process. Due to unexpected situations, a large number of timeout transactions may occur. In this case, the timing process continuously sends signals to the transaction processing process and sends timeout messages. The transaction processing process is busy processing timeout messages, resulting in delayed processing of normal transactions and causing more timeout transactions. To address this issue, it is considered to assign two types of processing processes to handle the messages read from the inbound routing queue in the BW platform and the messages read from the timing process, namely, to start another type of transaction processing process specifically for processing timeout messages read from the timing process message queue. The process of processing messages read from the inbound routing queue no longer reads messages sent by the timing process.

2. End-of-Day Processing Module Introduction

The end-of-day processing module mainly completes end-of-day business and batch processing. The end-of-day processing of the comprehensive front-end system consists of two main parts: system log dumping and transaction backup, and reconciliation with the core business system.

Advantages and Characteristics:

1. The overall architecture design adopts the "lean core, large periphery" design concept, which can flexibly expand financial business functions.

2. Transition from transaction-oriented to service-oriented design.

3. The simulated core system adopts a dual-core design, namely: accounting core and service core.

4. Flexible interface design, supporting quick and flexible access to various financial systems.

5. The transaction fees for all types of accounts within the system are automatically completed by the system.

6. Support for fine-grained peripheral business systems (e.g., off-site clearing, on-site clearing, media demonstration terminals, queuing machines, card readers, PIN pads, passbook/bill printing support systems, subject daily closing statements/reconciliation statements/report printing support systems, etc.).

7. Security design, adopting mature permission management and authorization management in business aspects, and unified key management platform and dynamic password system in technology aspects.

8. From the customer's perspective, it can achieve "zero maintenance, zero upgrade, zero intervention, zero operation."

9. Truly capable of supporting 24/7 community finance with multiple business functions, possessing business advantages that ordinary self-service finance cannot match.

10. The entire system architecture adopts business processes and technical implementations that are fully consistent with commercial finance, capable of fully integrating with existing commercial finance systems by 100%.

【MCDS】Bank IC Card System

Overview

One of the modern mass consumption tools, bank cards that use magnetic stripes as media, have been widely acknowledged for their convenience. However, in recent years, the escalating incidents of counterfeit cards and fraudulent activities have raised significant concerns about their security. With the trend of increasing globalization in financial economies and ongoing improvements in domestic financial reforms, the introduction of chips as media offers a solution to the high-risk issues associated with magnetic stripe cards. On the other hand, transaction processing is the core function of commercial banks. Improper handling not only leads to substantial financial losses but also has a significant adverse impact on the reputation and survival of commercial banks. Since the initiation of the Financial IC Card Application Project by the People's Bank of China, integrating the business application processing of financial IC cards into traditional banking systems while maintaining compatibility with traditional transaction processing and expanding future industry applications has become an urgent task for major domestic commercial banks.

In response to this financial landscape, Beijing Xinda Financial Education Technology Co., Ltd. has developed the MCDS Bank IC Card System to support the widespread promotion and application of financial IC cards in the domestic financial sector.

Logical structure

【MCDS】The Bank Electronic Cash Platform System

Overview

According to the Financial IC Card Project Plan, all acquiring terminals' renovation work to fully support the acceptance of financial IC card transactions was completed in 2011. In 2012, the issuance of financial IC cards was completed, including the renovation and construction of the issuance system, key management system, personalization system, and data preparation system. The electronic cash business mainly relies on the standard implementation of offline small-value payment functions based on financial IC cards, providing customers with fast and convenient payment while ensuring manageable business risks for the issuing bank.

By implementing electronic cash functionality, banks can strengthen business cooperation with related industries, such as public transportation cards, fuel cards, and highway ETC cards, achieving multi-application functionality. By enhancing card functions, banks can increase their market share in debit cards and subsequently increase intermediary business income.

The MCDS (Mobile Cash Distribution System) bank electronic cash platform system mainly facilitates offline consumption transactions at accepting terminals, where transaction amounts are directly deducted from the electronic cash account. When the balance in the electronic cash account is insufficient, online authorization can be requested to deduct from the cardholder's main account. Cardholders can recharge their electronic cash account through terminals or bank counters.

Conducting offline transactions with electronic cash is based on the electronic cash balance on the card. Subsequently, the issuing bank settles transactions based on the electronic cash account balance. If a payment transaction is not approved offline, online authorization is requested from the issuing bank. Online authorization typically involves authorizing and settling transactions for the cardholder's main account.

logical structure

【MCDS】Bank UnionPay Front-end System

Overview

In recent years, payment settlement tools have continuously evolved, with bank cards playing an increasingly important role as modern electronic payment instruments in the financial system. Banks have deployed a large number of ATMs and POS terminals across the country, making full use of UnionPay to provide customers with uninterrupted, cross-regional electronic financial services. The MCDS Bank UnionPay Front-end System, independently developed by Beijing Xinda Financial Education Technology Co., Ltd., adopts flexible transaction configuration management and modular design, facilitating the maintenance and management of application systems. This system is conducive to business integration and the expansion of emerging businesses, thereby reducing system development costs and management expenses.

Logical structure

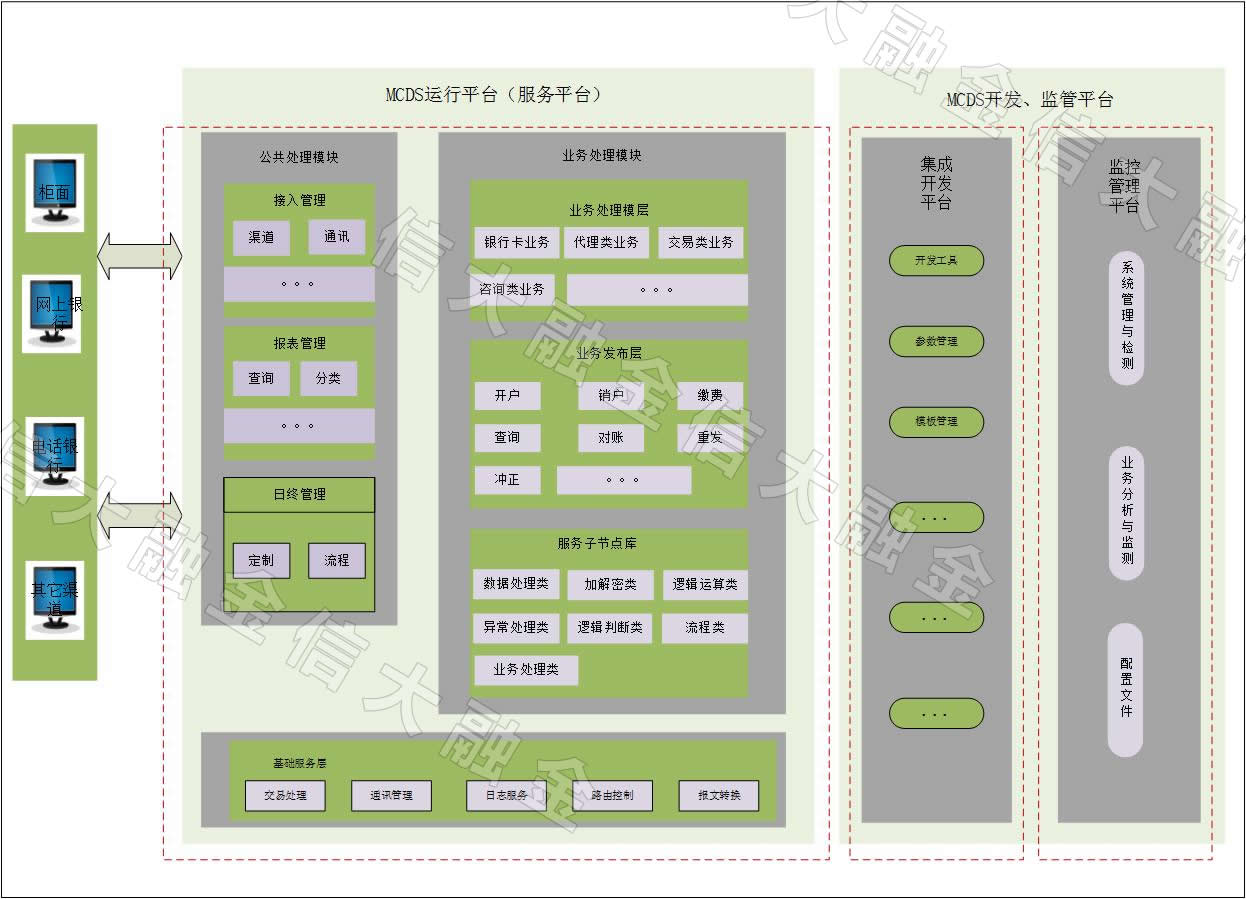

The "MCDS" Counter Service Front-end System

Summary

【MCDS】Counter Gateway Front-end System Software is a new generation online transaction processing platform developed and completed by Beijing Xinda Financial Education Technology Co., Ltd. in September 2013. Its main function is real-time transaction processing. Based on the 【BCFS】system, it can undergo rapid, simple, and effective secondary development according to different financial business needs to form customer demand software.

The functional features of the 【MCDS】Counter Gateway Front-end System Software include:

1) It is a 100% real-time transaction processing platform specially tailored for the financial industry, compliant with open standards, closely following various norms and standards of the financial industry, and supporting the latest UnionPay 2.1, PBOC 2.0, ISO20022, ANSI98, 3DES, etc.

2) It establishes a "customer-centric" secure and stable operation system under the "small core and large periphery" business integration platform.

3) It achieves "channel integration, business integration, information integration, and application integration."

4) It has an integrated development environment, comprehensive network protocol support, middleware support, and can be quickly implemented and deployed, integrating and integrating with existing commercial financial systems rapidly.

Logical Structure

The "MCDS" refers to the Bank's Fixed Telephone Banking System

Overview

With the improvement of living standards, large cash settlements and frequent transactions in various wholesale and retail markets have led to an increasing reliance on banks by merchants. In order to meet the demands of these clients, banks have adopted various service measures. However, they still fail to meet customer needs, resulting in the loss of some middle and high-end customers. At the same time, citizens are receiving an increasing number of bills to pay, and various factors such as different billing arrival times, payment deadlines, and bank payment outlets refusing to collect payments are making it increasingly difficult for citizens to make payments. The demand for convenient, quick, and personalized transfers and payment services from customers is becoming stronger.

In today's market where services win customers, banks have regarded improving service quality and enhancing service methods as important ways to compete for customer resources and explore market potential. Convenient, fast, and personalized service methods have also become one of the important goals pursued by the industry to meet market demand and improve industry competitiveness. The Bank Fixed Telephone Banking System developed by Xinda Financial is designed to meet the payment needs of bank cardholders in offices, communities, homes, wholesale and retail markets, and other places. It combines traditional bank card payment functions with fixed telephones, enabling bank cardholders to perform self-service card swiping payments, shopping, card-to-card transfers, credit card repayments, ticket reservations, and more at home, in the office, in communities, wholesale and retail markets, etc.

The MCDS Bank Fixed Telephone Banking System connects dedicated card-swiping telephones to the bank's settlement platform via PSTN telephone lines to enable POS card swiping payment functions. The system standardizes transaction interfaces and processing flows for different telephone devices, improves payment settlement methods, optimizes customer structures, enhances bank card transaction levels, and promotes comprehensive and rapid development of bank financial services.

Logical Structure

【MCDS】Bank ATM/CDM/VTM Front-end System Software

Summary

In recent years, the banking card business has experienced rapid development and widespread popularity, and 24-hour intelligent banking services have brought a lot of convenience to people's lives and work. Faced with the increasingly growing business, existing intelligent banking front-end systems in banks have exposed many problems and shortcomings: the multitude of self-service device models often leads to difficulties in upgrading applications when new devices are introduced, high upgrade costs, and long cycles; lack of standard management and monitoring tools, absence of a complete monitoring and warning system, and untimely detection and troubleshooting of faults; improvement is needed in the success rate of system transactions; loopholes exist in system security design, leading to occasional financial crime cases through information technology means; and a lack of multi-level management systems and remote management control tools.

In order to meet the increasing demands for intelligent banking in the market and to meet the future development trends of the banking industry, Xinda Financial Beijing Education Technology Co., Ltd., with its team members' years of experience in the banking software industry and rich experience in front-end systems, developed a new generation of online transaction platform in November 2013 based on market demand surveys. It provides commercial banks with a perfect ATM/CDM/VTM front-end system solution, helping bank customers establish feature-rich, advanced architecture, excellent performance, high stability, reliability, and security ATM/CDM/VTM front-end systems, which are widely used in many commercial banks nationwide.

logical structure

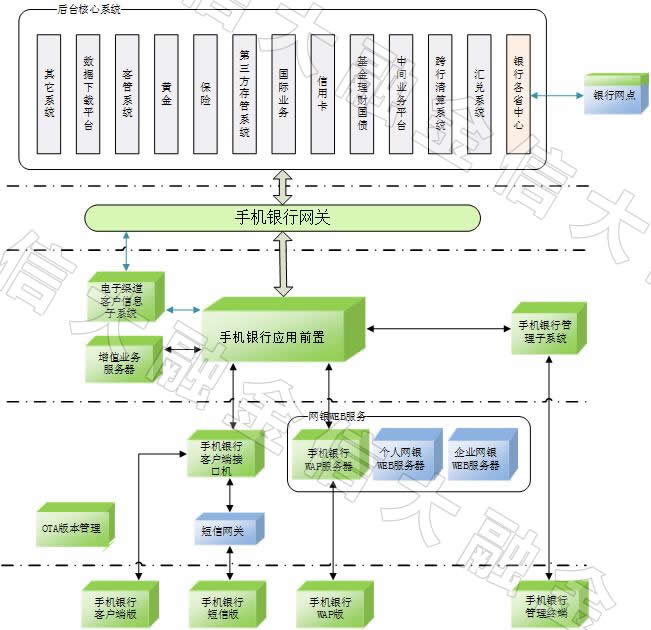

【MCDS】Bank Mobile Banking System Software

Overview

The overall objective of building the Xinda Financial Mobile Banking System (MCDS) is to establish a fully functional, convenient, secure, and reliable system that meets the innovative requirements of banking and financial services. It aims to greatly enhance the level of customer service, improve customer satisfaction, and foster loyalty through service channels. The functionalities of the Xinda Financial Mobile Banking System can be broadly categorized into counter processing functions, mobile front-end functions, and public management functions.

Among these, counter processing functions aim to integrate transactions such as mobile banking counter customer registration, account signing, password reset, etc., with existing counter transactions of telephone banking and online banking. These transactions are collectively integrated into electronic banking customer registration, maintenance, cancellation, query, account signing, account change, account cancellation, account query, password reset, electronic banking credential reissue, electronic banking credential unblocking, and related electronic banking counter reports. This enables the overall management of customer management, account management, information inquiry, password reset, electronic banking credential reissue, electronic banking credential unblocking, and relevant electronic banking counter reports across telephone banking, online banking, and mobile banking channels.

Logical structure

【MCDS】 Specialized Business Platform

Overview

In recent years, competition in the domestic banking industry has become increasingly fierce. The profits generated by traditional commercial banking operations are diminishing, prompting banks to seek and expand profit opportunities through specialized services. Overseas, commercial banks have developed mature specialized services. In countries like the United States, Japan, and the United Kingdom, specialized services contribute around 40% of total revenue. However, the development of specialized services in Chinese commercial banks has been less satisfactory. The scale and variety of specialized services offered by Chinese commercial banks are limited, hindering rapid development. Additionally, the industry faces significant low-end competition, which has impeded innovation and development.

Chinese commercial banks traditionally offer limited specialized services, mainly focused on settlement, agency, consultation, and cashing, with few varieties, limited financial innovation, and inadequate service functions, making them less attractive. In contrast, Western commercial banks offer a wide range of specialized services, with over 20,000 types identified, forming a comprehensive system mainly composed of settlement, derivatives, hedging, and credit services.

Beijing Xinda Financial Education Technology Co., Ltd., as a software service provider for multiple commercial banks, has been committed to providing excellent products and services to its customers. After years of practice and exploration in the financial industry, the company has summarized the common characteristics of financial business applications and adhered to the principle that there is demand in the market, banks have the capability, and business is profitable. The company has embarked on developing a new generation of specialized business platform systems. The MCDS specialized business platform is demand-oriented, providing localized financial services and enabling unified processing of specialized services across branches.

Logical Structure

【MCDS】Bank POS Terminal Management Front-end System Software

Overview

With the advent of the information age, banking operations have begun to move towards financial electronicization, leading to significant changes in people's lifestyles and consumption patterns. The financial Point of Sale (POS) system has emerged in response to this situation and is becoming an important means of fund flow and currency payment in China's financial industry.

POS stands for Point of Sales. The general process of POS transactions involves swiping a credit card on a POS machine and entering relevant transaction data (transaction type, amount, password, etc.). The POS machine then sends the obtained information (card number, transaction data, etc.) to the bank host through communication lines. The host processes the information and returns the corresponding processing result (usually called "authorization") to the POS machine, thereby completing a transaction.

The financial POS system consists of several parts, including POS terminals, network devices, hosts, and auxiliary equipment, which are interconnected through public telephone lines or packet-switched networks between bank computers and commercial outlets, toll stations, and financial outlets.

The MCDS Bank POS Terminal Management Front-end System Software is a new generation of online transaction processing platform developed by Beijing Xinda Financial Education Technology Co., Ltd. in September 2013. Its main function is real-time transaction processing. Based on MCDS, rapid, simple, and effective secondary development can be carried out according to different financial business needs, forming customer demand software.

Logical Structure

[MCDS] Multi-Industry, Multi-Application, Multi-Channel POS System Software

Overview

With the rapid advancement of science and technology, the pace of electronic finance in commercial banks is also accelerating. Currently, many domestic commercial banks are vigorously developing self-service banks, electronic banks, and interoperability with numerous third-party enterprises to rapidly expand their business. Commercial banks need an advanced business platform system to adapt to the constantly increasing and updating product demands, enabling banks to quickly introduce new products and services to the market through extensive service channels, thereby winning customers, capturing the market, and ultimately maximizing profits.

In the rapid development process of commercial banks, the secure and stable operation of systems, rapid business innovation, and effective investment in technology costs need to be directly addressed by commercial banks. The development of business and technology urgently requires a suitable platform system to address these issues.

Beijing Xinda Finance Education Technology Co., Ltd. has designed and developed a multi-industry, multi-application, multi-channel POS system software based on years of industry experience and rich project accumulation. It provides commercial banks with a perfect POS machine access monitoring solution, helping bank customers establish a fully functional, advanced architecture, high-performance, highly stable, highly reliable, and highly secure bank POS machine access system, which is widely used in many commercial banks nationwide.

Logical Structure

【MCDS】Banking Business Laboratory

Overview

【MCDS】Banking Business Laboratory is a financial research laboratory jointly established by Beijing Xinda Financial Education Technology Co., Ltd., through independent design, and cooperation with prestigious key universities in Beijing, focusing on banking business and researching future banking development models. The laboratory was founded in early 2013 and has received attention and support from institutions such as China Postal Savings Bank, Zhangjiakou Commercial Bank, and Beijing Information Technology University since its inception. The main research directions of the laboratory are the development direction and prospects of domestic commercial bank application systems in the next 10 years, as well as the future development plan of the banking industry. From the initial establishment of the bank vault area, traditional counter business area, and traditional self-service terminal area, it has developed to encompass a series of product research on community banks, smart banks, anti-money laundering systems, etc., closely following market demand and grasping the pulse of future banking industry development.

Currently, the planned areas of the laboratory include: traditional business simulation area, smart bank area, self-service equipment area, bank vault system area, application system research studio, and other areas with different functions. The design of each area is based on the needs of financial training and basic learning, and meets the teaching needs of banking, securities, and other experimental courses through simulation and simulation with certain data support.

Laboratory Environment Real Scene Image

Construction Plan

Beijing Xinda Financial Education Technology Co., Ltd.'s independently designed MCDS Banking Business Laboratory almost covers the mainstream design and planning concepts of current banks. From the deployment of functional areas to the construction of hardware and software, the latest facilities and technologies in the domestic banking industry have been utilized. Leveraging our independently developed BW comprehensive front-end platform, the authenticity and reliability of the laboratory's operating environment are ensured in terms of security and performance.

1. Hardware Design Environment

Following the design pattern of MINI Bank, risk control departments and backend office departments are designed, accompanied by our independently developed risk control system and backend data analysis tools. This setup creates a simulated trading environment for students, enhancing the interest and practicality of learning.

2. Software Resource Configuration

Utilizing global financial information terminals and analysis platforms to access various financial information in the domestic financial industry, a highly simulated matching mechanism is employed to cultivate students' practical abilities. Additionally, various training software developed independently by our company and partner universities are integrated, combining theoretical teaching with practical exercises to fully meet the requirements of teaching, research, and training expansion.

3. Later-stage Value-added Expansion

Building on the laboratory platform and drawing on the strengths of advanced university financial engineering laboratories in financial engineering, algorithmic trading, and financial derivatives analysis and research, foundational training is provided for high-end financial training.

Advantages and Characteristics

1. The application system is highly flexible and configurable.

2. The system allows convenient and rapid secondary development.

3. The system ensures highly secure encrypted transmission of data.

4. The system's business can be flexibly allocated, added, and deleted, demonstrating high business scalability.

5. The overall technical solution of the system adopts advanced industry architecture, with mature and stable software design concepts demonstrating advancement.

6. Future business development is considered during system construction, showing high foresight.

BW Regulatory Reporting Platform

BW Monitoring and Management Platform

The BW Teller Interaction System

BW Mobile Issuing Terminal

Customized Counter Exchange Platform

Customized counter small amount processing terminal

OCR Electronic Recognition and Verification System

Banking Core Business System

Cash Payment Receipt Recognition Management System

Banking Business Analysis System

Multi-channel Management Platform

Enterprise Service Bus (ESB) System

VTM Front-end System

The People's Bank of China's second-generation payment system

The same-city settlement system

Margin System

Financial and Tax Treasury Bank System

Financial and Tax Treasury Bank System

Treasury Authorized Payment System

The Fiscal Non-Tax System (Local)

The online verification system.

Prepaid Card Reserve Fund Supervision System

Funds Collection System (Personal/Enterprise)

The People's Bank of China Treasury Centralized Payment System

The physical precious metals trading system

Tax custody system

Financial Authorization Payment System (Central)

The Fiscal Non-tax System (Central)

Alipay Fund Supervision System

"Yinbao Tong" System

Trade System

Proxy Payment Service System

Western Union Money Transfer System

Funds Supervision System

One Card Pass System

The ETC system

Social Security System

The Housing Provident Fund System