- Xinda Finance Bank System Construction Model

- Xinda Finance Comprehensive Front-end System

- Xinda Finance【ESB Enterprise Service Bus】

- Xinda Finance Intermediary Business System

- Xinda Financial's UnionPay Front-end System

- Financial Industry Business Process Management Solution

- 【i-Bank】Mobile Market System

- Xinda Financial's SaaS (Software as a Service) offerings.

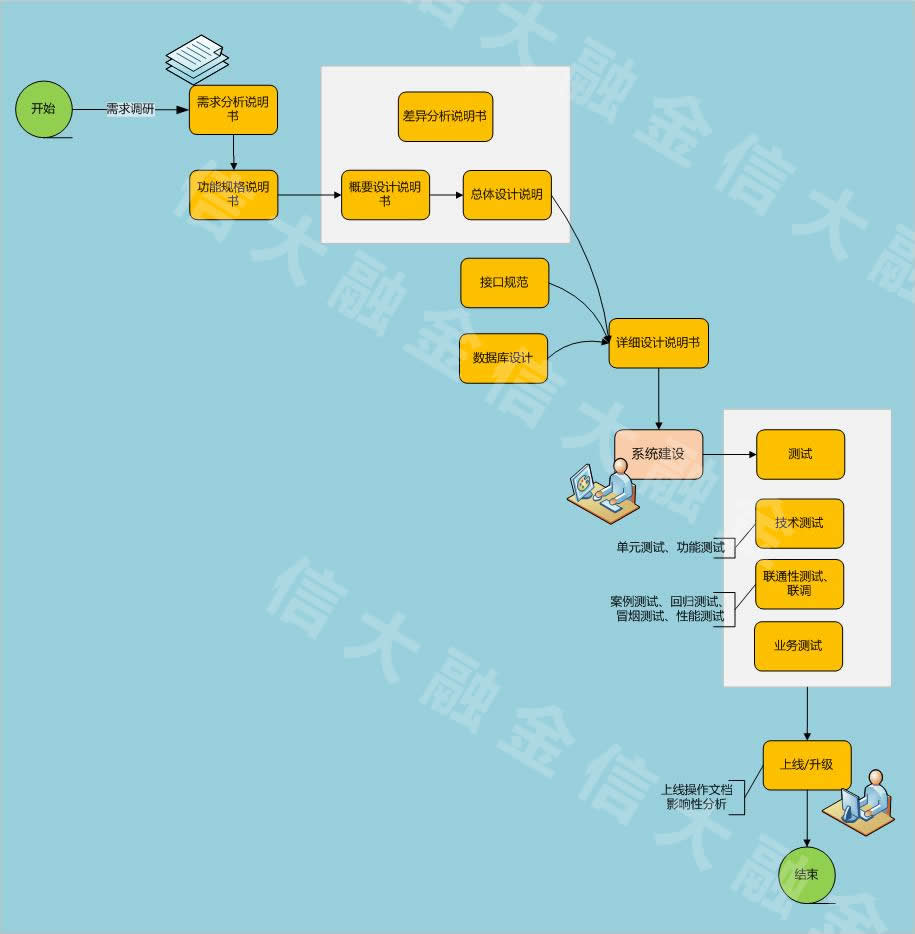

Banking System Construction Model

Xinda Finance has accumulated years of experience in banking system construction and has developed a typical system construction model.

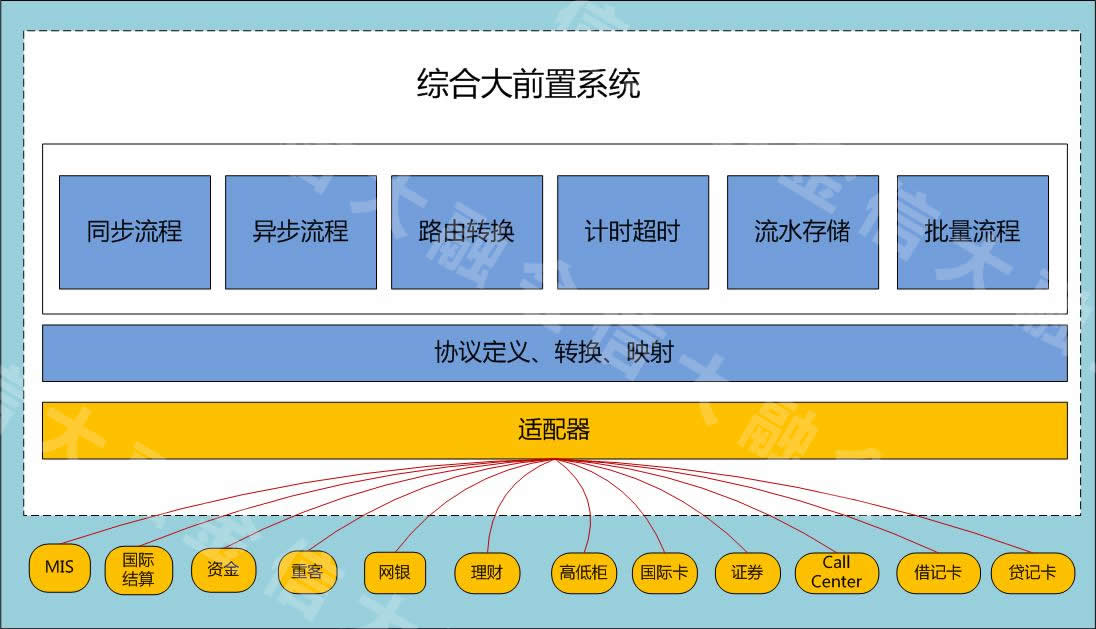

Xinda Finance Integrated Front-end Management System

Drawing on over a decade of accumulated experience, our proprietary 【MCDS】 product offers commercial banks a comprehensive large front-end solution and a range of business front-end system solutions. It has been widely and successfully deployed in numerous commercial banks nationwide. The "MCDS-Comprehensive Large Front-end System" solution, with its advanced design concepts and cutting-edge technology, comprehensively assists commercial banks in achieving a "lean core-large periphery" architectural trend. It establishes a secure and stable operational system centered around the customer, enhances the bank's management and decision-making capabilities, and improves market risk control and responsiveness.

Integrated front-end system | ||

Serial number | System Name | Scope of Business |

1 | UnionPay Front-end System | Balance inquiry, withdrawal, purchase, purchase reversal, purchase cancellation, deposit, deposit cancellation, deposit confirmation, return, pre-authorization, additional pre-authorization, pre-authorization cancellation, pre-authorization completion, sign-in/sign-out, key reset, date change, line testing, etc. |

2 | Clearing and Settlement System | Clearing file parsing, total reconciliation, fund settlement, reconciliation, clearing, file processing, merchant settlement. |

3 | Bank IC Card System | IC card transactions mainly consist of online transactions, offline transactions, and management transactions. For example, transactions across different channels such as inquiries, withdrawals, purchases, pre-authorizations, offline purchases, offline pre-authorizations, as well as functions like check-in/check-out, key management, and management of black, gray, and white lists. This section focuses on explaining online and offline transactions of IC cards, including transaction types, transaction processes, and IC card transaction management functions |

4 | Middle Office System | "Middle office business" is a very broad concept, typically defined as business transactions between banks and external systems. Examples include third-party payments, collection and payment services, central finance, bank-insurance connectivity, customs trade systems, fund pooling, and inter-city bill exchange, among others |

5 | Shanghai Clearing House | Ordinary remittance, transfer credit, password remittance out, password remittance withdrawal, password remittance return, return application, remittance return, password remittance return, inquiry, reply to inquiry, cancel remittance. |

6 | ATM/VTM Front-end System | Check balance, deposit, re-deposit, withdraw, withdraw reversal, cardless withdrawal, interconnection withdrawal, intra-bank card-to-card transfer, intra-bank card-to-card transfer reversal, account statement inquiry, account information inquiry, change password. |

7 | POS Front-end System | Balance inquiry, purchase, purchase reversal, purchase cancellation, refund, pre-authorization, pre-authorization cancellation, pre-authorization completion, check-in/check-out, key reset, etc. |

8 | The People's Bank of China's Second Generation Payment System | The People's Bank of China's second-generation payment system is divided into large-value payment system, small-value payment system, and internet banking interconnection. The operations include: credit submission, debit submission, reversal transaction, core query transaction, submission of abnormal transaction query, submission of return, credit submission, debit submission, return submission, inquiry submission, posting submission, session inquiry, etc. |

9 | Counter system | The counter terminal system is divided into high-counter and low-counter services. High-counter services include deposits, withdrawals, transfers, inquiries, etc., while low-counter services include financial management, funds, etc. |

10 | Supply chain system | Internal management queries customer information, B2B data requests, adding, modifying, and deleting credit institutions, credit institution information inquiries, and online banking initiating SCF transaction details. |

11 | International Business System | Establishment of comprehensive service for loan agreements, creation of letter of guarantee agreement services, deletion of letter of guarantee agreement services, account information inquiry, establishment of letter of credit registration service, spot inquiry transaction query, settlement of letter of credit registration service, comprehensive trial calculation allocation service, electronic channel customer account information browsing |

12 | Check image system | Teller sign-in for the bill system, inquiry of bill business account information, manual status synchronization, reconciliation of the bill system's general ledger, reconciliation of bill system details, registration of check withdrawal information, registration of check deposit information, and handling of bill business corrections. |

13 | Credit card system | Establishment of corporate customer information, modification of corporate customer information, establishment of individual customer information, inquiry of individual customer information, user identity authentication check, unified reversal entry. |

14 | Savings Bonds System | Opening of national debt custody accounts, closure of national debt custody accounts, subscription for savings bonds, early redemption of savings bonds, inquiry of specified national debt transaction history, unpacking of multiple queries for national debt codes, inquiry of account opening information, self-service pledged loan inquiry, verification of national debt information inquiry, application for self-service pledged loan, debt conversion for self-service pledged loan, loan settlement for self-service pledged loan, etc. |

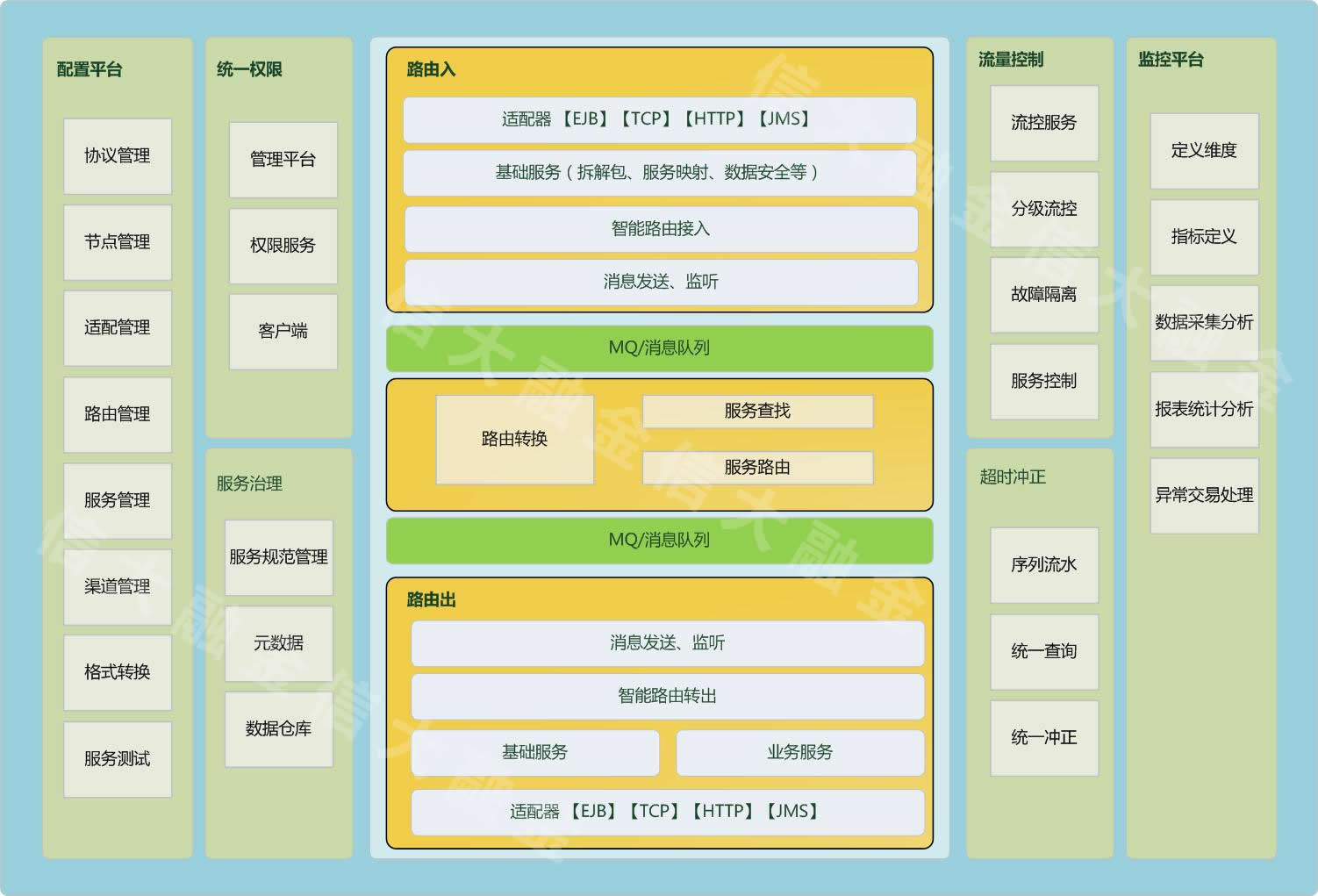

Xinda Finance【ESB Enterprise Service Bus】

By constructing the ESB platform, it enables the establishment of a standardized and normalized information superhighway among all banking application systems, which is currently the most mainstream solution for the overall IT architecture construction in commercial banks. ESB emphasizes the concept of "Service," highlighting the "S" in its abbreviation. It decomposes all banking business applications into a group of banking services, then defines standardized and procedural service specifications through methods that meet the needs of banking business development and industry standards. Each service in the service specification has a clear business meaning, with defined input and output, and a globally unique service interface. All systems can complete customer business logic processing by calling this service. Under the new architectural framework, ESB becomes the central node connecting all IT systems of the entire bank. The security, stability, and efficiency of the ESB platform will greatly influence the operation of all systems across the bank. A well-designed ESB platform can significantly enhance the operational level of all IT systems across the bank. Through ESB project construction, the IT system resources of commercial banks are integrated, and a multi-layered, line-based, loosely coupled system architecture is established.

ESB is analogous to the "expressway" in real life, connecting the head office, branches, and outlets, serving as the main artery of banking operations. The construction of ESB greatly enhances the overall capability of commercial bank IT systems

1.The future path for process banking, branch transformation, and internet banking development. Currently, ESB has become the most mainstream choice for commercial bank IT architecture construction, serving as a critical technological support for commercial banks to respond to rapid market changes.

2.Facilitates the introduction of innovative banking services. In the face of fierce competition, trends such as interest rate liberalization, internet finance, third-party payments, and diversified operations necessitate that banks establish agile IT architectures capable of responding rapidly. Leveraging the mature system integration capabilities and service composition functionality of ESB, banks can combine a greater variety of services to meet the needs of innovation and diversified operations.

3.Facilitates comprehensive improvement in the technological management level and capabilities of banks. According to reports from Forrester Research, ESB integrates existing and newly built systems, processes, and services of commercial banks, enhancing flexibility to promote development and strengthen control over critical resources, thereby helping enterprises realize the value of SOA.

Xinda Finance Intermediary Business System

In a broad sense, intermediary business refers to activities that do not constitute on-balance sheet assets or liabilities for commercial banks, but generate non-interest income for banks. Leveraging their advantages in technology, information, institutional networks, funds, and reputation, commercial banks act as intermediaries and agents on behalf of clients to handle payments, consultations, agency, guarantees, leasing, and other entrusted matters. They provide various financial services and charge certain fees for their operations, with limited or no use of the bank's own funds.

The List of Middle Office Systems | ||

Type | Serial Number | System Name |

Head Office Middle Office System | 1 | Third-party payment system |

2 | Western Union Money Transfer System | |

3 | Proxy for the U.S. Embassy's Business System | |

4 | Trade Management System | |

5 | Bank-Insurance Integration System | |

6 | Alipay Fund Supervision System | |

7 | Central Fiscal Non-Tax System | |

8 | Central Treasury Authorized Payment System | |

9 | Tax Custody System | |

10 | Precious Metal Physical Trading System | |

11 | People's Bank of China Central Treasury Payment System | |

12 | Personal Funds Collection System | |

13 | Shanghai Futures Exchange System | |

14 | Prepaid Card Reserve Fund Supervision System | |

15 | Payment of UK Visa Application Service Fee | |

16 | Online Verification | |

Branch Middle Office System | 1 | City-wide Clearing System (Local Check Clearing) |

2 | Margin System | |

3 | Financial Tax Treasury System | |

4 | Collection Fee | |

5 | Local Finance Authorized Payment System | |

6 | Local Fiscal Non-tax System | |

7 | Public Provident Fund System | |

8 | Social Security System | |

9 | Electronic Toll Collection System | |

10 | One Card System | |

11 | Funds Supervision System | |

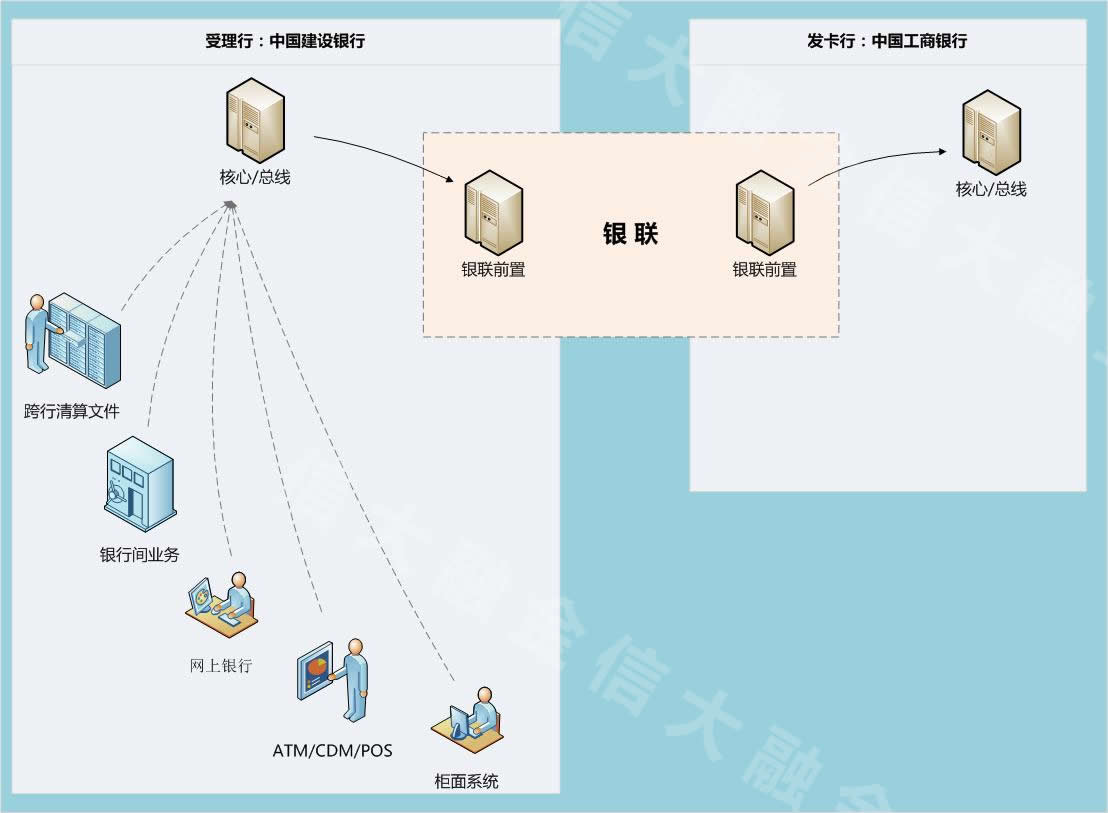

Xinda Financial's UnionPay Front-end System

The UnionPay Front-end System is a crucial component of various banking systems, responsible for handling all interbank transactions. It enables interconnection of bank card transactions through the UnionPay processing center. Each bank must develop a corresponding UnionPay Front-end System internally to connect with the UnionPay center for processing interbank transactions involving non-local bank cards.

Category | Transaction Name | |

Issuer transaction | ATM transactions | Balance inquiry transactions, withdrawal transactions, withdrawal reversal transactions, deposit transactions, deposit cancellation transactions, deposit confirmation transactions, incoming transfer transactions, incoming transfer confirmation transactions, outgoing transfer transactions, outgoing transfer reversal transactions. |

Point of Sale (POS) transactions | Balance inquiry transaction, consumption transaction, consumption reversal transaction, consumption cancellation transaction, consumption cancellation reversal transaction, deposit transaction, deposit cancellation transaction, deposit confirmation transaction, return transaction, pre-authorization transaction, pre-authorization reversal transaction, additional pre-authorization transaction, additional pre-authorization reversal transaction, pre-authorization cancellation transaction, pre-authorization cancellation reversal transaction, pre-authorization completion transaction, offline pre-authorization completion transaction / settlement notification, pre-authorization completion reversal transaction, pre-authorization completion cancellation transaction, manual pre-authorization cancellation transaction, pre-authorization completion cancellation reversal transaction. | |

Error transaction | Exception handling, interbank transfer transaction online adjustment, ATM deposit error processing, credit adjustment, request, re-request, refund, secondary refund, manual return, manual authorization completion, payment and collection fees. | |

Acquirer transaction | ATM transactions | Balance inquiry transaction, withdrawal transaction, withdrawal reversal transaction, deposit transaction, deposit cancellation transaction, deposit confirmation transaction, agency transfer transaction, transfer-in transaction, transfer-out transaction, transfer-out reversal transaction. |

Point of Sale (POS) transactions | Balance inquiry transaction, purchase transaction, purchase reversal transaction, purchase cancellation transaction, purchase cancellation reversal transaction, deposit transaction, deposit cancellation transaction, deposit confirmation transaction, return transaction, pre-authorization transaction, pre-authorization reversal transaction, additional pre-authorization transaction, additional pre-authorization reversal transaction, pre-authorization cancellation transaction, manual pre-authorization cancellation transaction, pre-authorization cancellation reversal transaction, pre-authorization completion transaction, pre-authorization completion reversal transaction, offline pre-authorization completion transaction, pre-authorization completion cancellation transaction, pre-authorization completion cancellation reversal transaction. | |

Management transactions | Check-in, check-out, apply for keys, line testing, initiate key reset. | |

Financial Industry Business Process Management Solution

【i-Bank】Mobile Market System

SaaS stands for Software-as-a-Service, which is a completely innovative software application model that emerged with the development of Internet technology and the maturity of application software at the beginning of the 21st century. It shares similar meanings with "on-demand software," application service provider (ASP), and hosted software. SaaS is a model of delivering software over the Internet, where vendors deploy application software on their own servers. Customers can subscribe to the required application software services from vendors based on their actual needs through the Internet. They pay fees to vendors based on the quantity and duration of the subscribed services and access the services provided by the vendors via the Internet. Users no longer need to purchase software but instead rent web-based software from providers to manage business activities. They do not need to maintain the software, as the service provider will fully manage and maintain it. Additionally, while offering internet-based applications to customers, software vendors also provide offline operation of the software and local data storage, enabling users to access the subscribed software and services anytime and anywhere. For many small businesses, SaaS is the best way to adopt advanced technology, as it eliminates the need for businesses to purchase, build, and maintain infrastructure and applications.