- Warm congratulations on the acquisition of the first computer software copyright

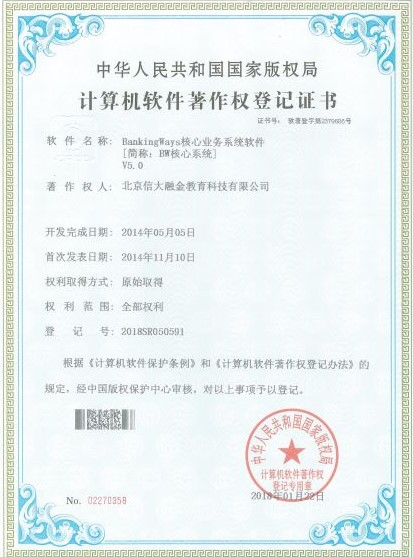

- Bw Core System of the company to obtain a soft copyright

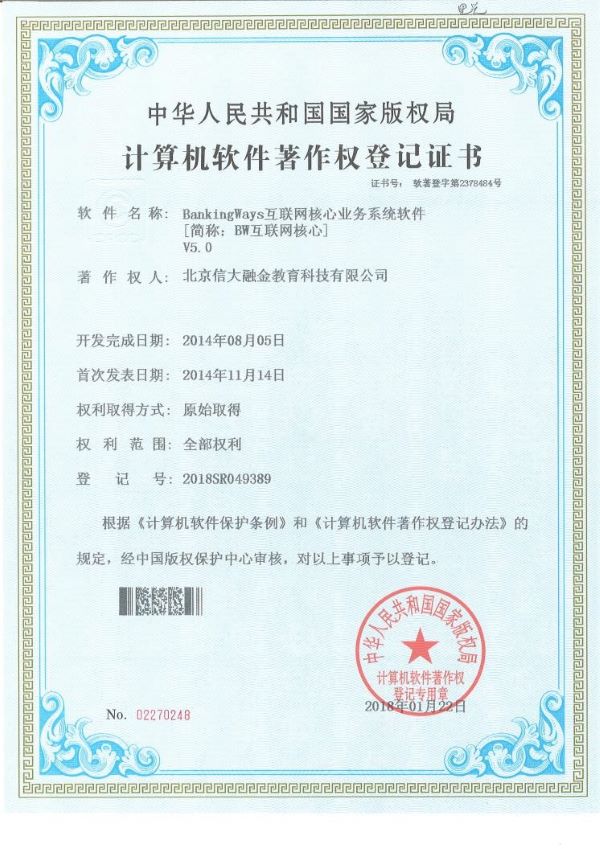

- The company's Internet core has been granted a soft-book license

- Our company's signing ceremony for cooperation with Zhang College

- Xinda Financial holds the 2021 Marketing Summary Conference

- New Year Greetings from Xinda Financial for 2022

- Xinda Financial Bank Product Architecture Launch

- Xinda Financial Releases Two Software Products in Beijing

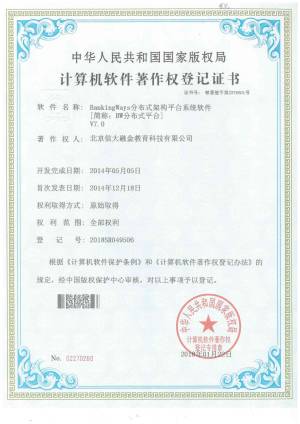

On June 26, 2014, the BW Multi-Channel Integration Platform, independently developed and implemented by Xinda Financial, obtained authorization for computer software copyright from the National Copyright Administration. The software is named "BankingWays Multi-Channel Integration Platform【abbreviated as: BW Platform】V1.0," with the certificate number: Software Copyright Registration No. 0755514.

To become a pioneer and leader in the introduction of international banking core business systems, Beijing Xinda Financial Education Technology Co., Ltd. (referred to as Xinda Financial) took the lead in embarking on the localization journey of international banking core business systems. The BW Multi-Channel Integration Platform represents a significant and powerful step forward in this endeavor.

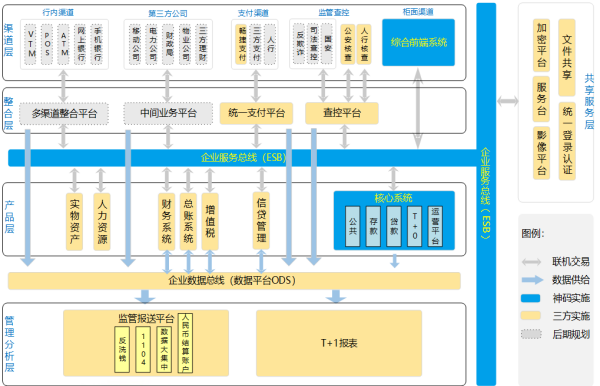

What is the BW Multi-Channel Integration Platform?

The BW Multi-Channel Integration Platform is a business application built on the various functional modules of the Financial Service Bus (ESB), providing a foundation on the infrastructure of the ESB's basic technology. Each channel system connects to the ESB through communication adapters and message adapters provided by the access container. They enter the ESB through the core route and access the Channel Integration Platform within the service container. This platform completes logical processing of transaction processes such as channel control, limit control, and business processes like channel agreements. Simultaneously, through the service invocation function of the service container, original service requests such as account queries and transfers are routed through the core route to other business systems, completing the entire transaction process. If there are specific service combinations for electronic channels, the ESB access container will provide underlying technical support. The Channel Integration Platform will use other standard services for service invocation, and the invocation request will be routed through the ESB core route to the access container for processing.

The overall architecture of the Channel Integration Platform is shown in the diagram. All technical infrastructure functions related to communication adaptation, message adaptation, service routing, service composition, etc., will be provided by the ESB. ESB will handle the application integration work for various electronic channels, and the Channel Integration Platform will serve as a service provider, focusing on completing the business integration work for electronic channels.

What are the characteristics of the BW Multi-Channel Integration Platform?

1. Outstanding Design Philosophy

The Channel Integration Platform is a unified platform connecting various channel systems to backend business systems. Any channel integrated into this platform can transparently access all backend systems. The core functionalities of this platform include controlling session rules and process rules for business systems. The construction of this platform provides standard interfaces and process services for channel systems.

The Channel Integration Platform includes modules for user management, business institution management, channel transaction switch management, business monitoring management, customer information management, transaction limit management, billing management, and report statistics management. It offers an architecture for multi-channel unified access, fully supporting call center integration system transaction processing and backend business management.

The primary goals of the Channel Integration Platform are as follows:

Expanding the signing process while considering the foundation of multi-channel access in electronic banking, achieving integrated signing for electronic banking (customer signs up once at the counter, and all channels interactively activate). This supports unified channel business norms, service standards, and processes to better meet customer needs, thereby increasing customer satisfaction and providing a consistent banking service experience.

Completing the construction of the system architecture, integrating common transaction processes while maintaining the characteristics of sub-channels, unifying interface formats, providing fast and efficient transaction processing functions, maximizing the reuse of transaction application logic, reducing the overall cost of channel systems (TCO), and reducing the workload of transaction development related to backend business systems. This includes achieving unified product management functionality, one-time product development, multi-channel deployment, and rapid deployment of new channels through a clear hierarchical structure, enhancing market responsiveness.

Adding transaction institution management, optimizing billing management, and monitoring management components to achieve optimization and perfection of platform functionalities. Ultimately, it involves extracting customer information, product process information, transaction information, and management information from various electronic channels, unifying storage, organically integrating common transaction business logic and management functions, providing integrated and standard business access interfaces to various front-end channels. This enables multi-channel customer signing, flexible transaction control, standard business parameter setting, monitoring alerts, statistical reports, etc., supporting each channel in providing convenient, secure, and personalized services to customers, enhancing the level of bank business management, and strengthening business risk prevention and control capabilities.

2. Specialized Application Architecture

The application architecture of the Channel Integration Platform is illustrated in the diagram: built upon the ESB service container, it provides four major categories of business service functions. The primary function is integration services, which integrate customer, product, service, and channel dimensions. This layer formulates a unified strategy for the development of electronic channel products and services, enabling targeted marketing of products and services.

3. Advanced Technological Architecture

The technical architecture used for the channel integration platform aligns with the standard of the ESB service container. It supports multiple communication protocols and message formats, structured and designed according to the Service-Oriented Architecture (SOA).

4. Clear Physical Network Architecture

The physical network architecture used by the channel integration platform is illustrated in the diagram:

The acquisition of this software copyright certificate is a significant milestone in our company's research and development efforts. It signifies a new step forward in our independent development of international banking core business systems. This achievement is also a testament to Xinda Financial's core technology and robust technological capabilities, demonstrating our commitment to specialized expertise. In the future, Xinda Financial will continue to increase research and development investment, adhere to the path of continuous innovation, leverage the innovative power of digital technology, and provide customers and partners with more valuable products and services. We aim to lead the development of smart banking operations!

In the fiercely competitive financial environment and amidst the rapid development of internal banking operations, the construction of bank information systems requires a high level of foresight. Therefore, the development of the next generation of core banking business systems is not merely about a simple bank core system. It involves not only the front, middle, and back offices, including counter operations, electronic channels, application integration, and a series of applications but also considerations for unique domestic features such as intermediary business, bank cards, and challenges brought by the payment, regulatory, and system construction issues.

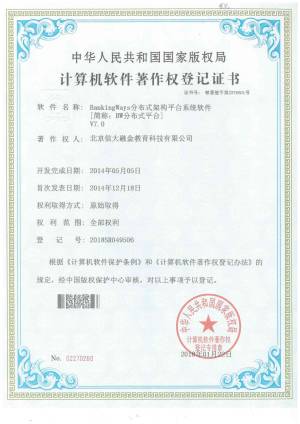

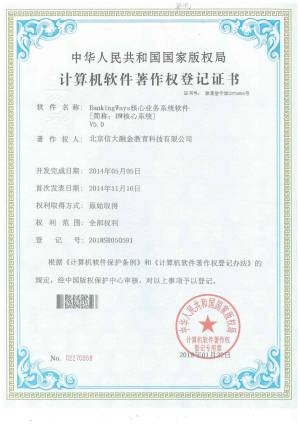

On January 22, 2018, the core business system software product developed and implemented independently by Xinda Financial obtained the authorization for the computer software copyright from the National Copyright Administration. The software is named "BankingWays Core Business System Software【abbreviated as: BW Core System】V5.0," with the certificate number: Software Copyright Registration No. 2379686.

What is the BW Core System?

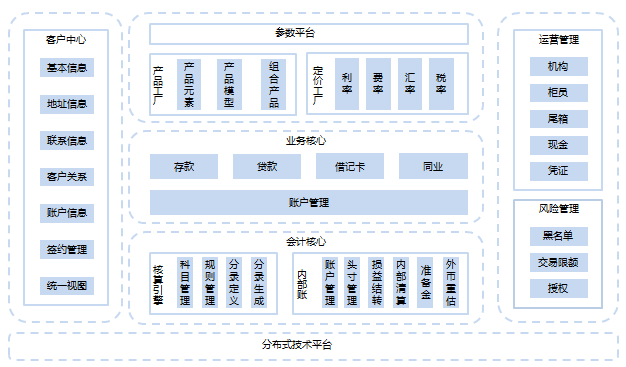

The BW Core System adopts open platform technology and is based on Service-Oriented Architecture (SOA) design. It achieves the design goals of 'supporting the integration of banking business, business process reengineering, and the rapid launch of new products.' The system includes several components such as Customer Center, Parameter Platform, Product Factory, Pricing Factory, Account Management, Accounting Engine, Internal Accounts, Operations Management, Risk Management, various external interfaces, and the Core System Frontend. It provides modules for Customer Information Management, Organizational Structure Management, and Authorization Management. Additionally, it offers functionality for configuring and managing banking products such as deposits, loans, payment settlement, and fund management through the Product Factory, along with transaction processing capabilities. The functional architecture is illustrated in the diagram below:

What are the advantages and features of the BW Core System?

Firstly, the BW Core System is designed with a genuine customer-centric philosophy. It goes beyond the superficial business operations conducted through customer numbers and focuses on effectively collecting customer information. This allows various customer-related information to be rapidly utilized across different aspects of customer service, such as risk control, pricing strategies, and service modifications, based on existing customer habits.

Secondly, the BW Core System adopts a dual-core architecture, with independent development of business processing and accounting calculation functions. It combines the trend of platforming application systems using a unified technical framework, resulting in the development of a completely new generation of bank core business systems known as the 'Dual-Core Platform.' In the era of openness and integration characteristic of the internet, it provides a practical path for the integration of bank business development. The innovative concept of 'Dual-Core Platform' not only redefines the functionality of bank core business systems but also represents the future trend in the development of core business systems.

Lastly, the BW Core Business System features advanced design principles and technological architecture: customer-centric and financial product factories, modular and parameterized design, significantly enhancing the system's flexibility and business innovation capabilities. The use of parameterization and product factories enables rapid product customization, business innovation, and business combinations.

In addition to these three points, the BW Core System also excels in areas such as expanding core services, driving core system operations, enhancing customer experience, and increasing customer stickiness.

Addressing pain points in the current traditional banking business development and digital transformation process, the next-generation BW Core Business System will provide the core value of being 'simpler, smarter, and providing a superior experience' for banking digital transformation. According to Xinda Financial, the core system crafted with ultimate distributed design possesses characteristics of intelligence, openness, and a 'customer-centric' approach, capable of generating long-term business value.

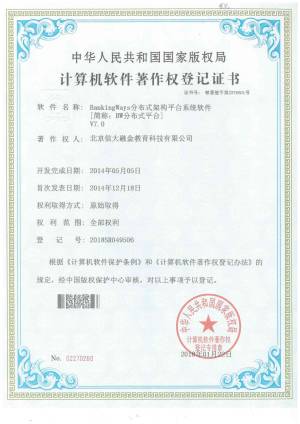

On January 22, 2018, the BW Internet Core Business System software, independently developed and implemented by Xinda Financial, obtained authorization for computer software copyright from the National Copyright Administration. The software is named "BankingWays Internet Core Business System Software【abbreviated as: BW Internet Core】V5.0," with the certificate number: Software Copyright Registration No. 2378484.

Drawing on years of accumulated experience in the banking sector and the expansion of internet business, Xinda Financial has innovatively developed the BW Internet Core. The objective is to assist banks in addressing the distinctive pain points associated with conducting internet business, including differences in user and customer preferences, distinctions between internet accounts and traditional deposit and loan accounts, and variations in marketing internet products versus customizing traditional products. This initiative aims to establish a foundational business platform tailored for internet business applications, enabling banks to realize a platform-oriented strategy for developing internet services.

What internet basic business support does the BW Internet Core include?

1、Internet User Management: Manages various types of information related to internet users, including identity authentication, behavior collection, user growth, social interactions, and user tags.

2、Internet Account System: Supports various types of internet accounts through the construction of a distributed account architecture, such as Type II/III accounts, red envelope accounts, points accounts, virtual accounts, group multi-legal entity accounts, and various types of internet custody accounts.

3、Internet Product Marketing: This feature facilitates the packaging, listing, display, channel management, precise push to users, and market promotion of banking financial products on the internet.

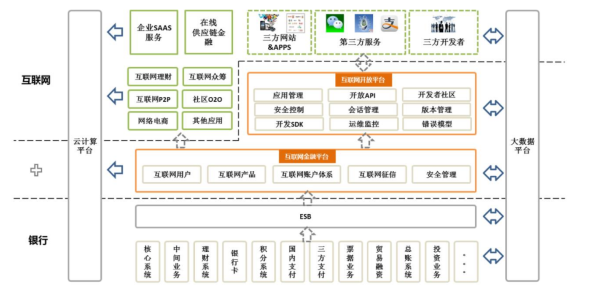

(The architecture of the BW Internet Core product is illustrated in the diagram below.)

As can be seen, the BW Internet Core is built on Xinda Financial's distributed development and operation platform, realizing distributed processing of applications and data to meet the characteristic requirements of high internet traffic, concurrency, and rapid iteration.

In the era of the internet, an increasing number of industries are evolving towards a platform-based business model. Various industry supply chains are showing a trend towards platform development, where the core participants in the supply chain expand their ecosystems upstream and downstream by building platforms. For banks to thrive in the long term on the internet, it is not just about developing various internet financial applications. It is equally important to develop their own platform, achieving a strategic development pattern based on the platform, with applications as breakthroughs in the large platform and small application strategy.

To become a pioneer and leader in the introduction of international banking core business systems, Xinda Financial has taken the lead in the localization of international banking core business systems. The BW Internet Core represents a significant and powerful step forward in this journey.

On the afternoon of December 18, 2020, the award ceremony and signing ceremony for the first "Jinhong Cup" Creative, Innovative, and Entrepreneurial (Three Innovations) Competition of Zhangjiakou Vocational and Technical College took place in the third-floor lecture hall of the Comprehensive Administration Building. In order to strengthen cooperation between the college and enterprises, Zhang Yanfeng, Chairman of Beijing Xinda Financial Education Technology Co., Ltd., attended the signing ceremony.

Zhang Yanfeng pointed out: General Secretary Xi Jinping's instructions on youth being the hope of the nation and the soul of social progress being innovation, along with entrepreneurship being a crucial means to drive economic and social development and improve people's livelihoods, have provided our company with guidance. Participating in the first "Golden Hong Cup" Creative and Innovative Entrepreneurship (Three Innovations) Competition at Zhangjiakou Vocational and Technical College and serving as a "business mentor" and "visiting professor" is not only a significant responsibility for him but also a meaningful challenge.

He also emphasized: Talent cultivation plays a crucial role in the development of enterprises. School-enterprise cooperation provides a good platform for enterprises, aligning with societal trends and corporate needs. Enterprise participation is a necessary path for school-enterprise cooperation and a solid foundation for the continuous development of education, promoting mutual benefits for both parties. Beijing Xinda Financial Education Technology Co., Ltd. will contribute to promoting school-enterprise cooperation, optimizing research collaboration, talent development, and providing dual-growth services.

After the speech, Zhang Yanfeng and the dean, Wang Lijun, signed a cooperation agreement. Additionally, Zhang Yanfeng made a donation of 1 million RMB to the school, aiming to jointly establish a school-enterprise internship and employment base. The goal is to continuously enhance the precision of skill talent training services, empower and unite efforts to drive high-quality development in enterprises. This collaboration aims to achieve a true win-win situation for the school, enterprises, and graduates.

To summarize experiences, boost morale, and further promote the faster and better development of the company to achieve the goals for 2022, on December 28, 2021, Beijing Xinda Financial Education Technology Co., Ltd. held the annual marketing conference. The meeting was attended by Chairman Zhang Yanfeng, Marketing Center Director Zhang Xiaojie, department managers, and hundreds of sales elites from various marketing regions. The conference was presided over by Zhang Xiaojie, the Director of the Marketing Center.

In the special documentary "Unity and Pursuit - Marketing Special," all participants were passionate and full of energy as they reviewed the marketing efforts of 2021. Throughout the year, Xinda Financial closely followed the development goal of "Quality Improvement Year," and the marketing team united with one heart, striving to catch up and surpass, taking a solid step on the journey towards a brighter future. With everyone working together and pushing forward against all odds, it is in facing challenges that we move forward, ultimately leading to the shining moment for Xinda Financial!

Before the event commenced, Chairman Zhang Yanfeng delivered a speech. He commended the achievements of the Marketing Center throughout the year, emphasizing that in the coming year, while ensuring the overall high-speed growth of the company's sales, the marketing team will advance various market activities based on the core idea of "adhering to three unwavering commitments, achieving three major breakthroughs, and focusing on three major guarantees." Regarding the marketing management team, it is essential to steadfastly adhere to the goals of network

infrastructure development, model market construction, and the rigidity of product prices, as well as the execution of cost control. The objectives include unwavering commitments to customer cultivation, product structure improvement, comprehensive breakthroughs through multi-channel coordination, accelerating the digitization and transformation of marketing,continuously expanding the marketing team, and achieving the coordination of marketing organization and refined operations. Director Zhang Xiaojie of the Marketing Center stated: "This year, with the concerted efforts of all employees, the company has intensified market expansion efforts and acquired new clients such as Huaxia Bank, Industrial Bank, and Chongqing Rural Commercial Bank. As we approach the upcoming year, the market environment is becoming more complex and challenging, with intensified industry competition. The Marketing Center is adjusting its structure and has established a guiding principle of 'building a system, enhancing capabilities, expanding the market, promoting growth, and building the brand.' This aims to consolidate advantages in existing markets, explore new areas and markets, seek new opportunities, and implement market strategies to counter any market invaders. He emphasized the need to be well-prepared, strategically arranged, and maturely organized to navigate the challenges, as facing crises and resolving them is an essential path for a mature organization. In marketing and sales, we should showcase the unique characteristics of Xinda Financial, work together as a team, focus on key initiatives, and ensure victory together!"A purposeful life has direction, and a planned life is even more exciting." Under the guidance of the leaders in the marketing department, the team successively took the stage to sign the declaration of goals for 2022. Each word of the solemn oath echoed with strength, sounding the annual performance charge. Each declaration, infused with unwavering beliefs, bears the responsibility and dedication of Xinda Financial's marketing team. Amidst the passionate and stirring oath slogans, it affirmed everyone's ignited fighting spirit and determination. With high spirits, exuberance, and unwavering confidence, we are bound to achieve this year's performance goals!

Director Zhang Xiaojie of the Marketing Center stated: "This year, with the concerted efforts of all employees, the company has intensified market expansion efforts and acquired new clients such as Huaxia Bank, Industrial Bank, and Chongqing Rural Commercial Bank. As we approach the upcoming year, the market environment is becoming more complex and challenging, with intensified industry competition. The Marketing Center is adjusting its structure and has established a guiding principle of 'building a system, enhancing capabilities, expanding the market, promoting growth, and building the brand.' This aims to consolidate advantages in existing markets, explore new areas and markets, seek new opportunities, and implement market strategies to counter any market invaders. He emphasized the need to be well-prepared, strategically arranged, and maturely organized to navigate the challenges, as facing crises and resolving them is an essential path for a mature organization. In marketing and sales, we should showcase the unique characteristics of Xinda Financial, work together as a team, focus on key initiatives, and ensure victory together!"A purposeful life has direction, and a planned life is even more exciting." Under the guidance of the leaders in the marketing department, the team successively took the stage to sign the declaration of goals for 2022. Each word of the solemn oath echoed with strength, sounding the annual performance charge. Each declaration, infused with unwavering beliefs, bears the responsibility and dedication of Xinda Financial's marketing team. Amidst the passionate and stirring oath slogans, it affirmed everyone's ignited fighting spirit and determination. With high spirits, exuberance, and unwavering confidence, we are bound to achieve this year's performance goals! Marketing Center Director Zhang Xiaojie led the oath with great passion, embodying the confidence of all marketing personnel in their future work. We will unite our hearts, step forward towards larger goals, and strive to achieve greater success with a spirit that sees the future, collectively creating glory!

Marketing Center Director Zhang Xiaojie led the oath with great passion, embodying the confidence of all marketing personnel in their future work. We will unite our hearts, step forward towards larger goals, and strive to achieve greater success with a spirit that sees the future, collectively creating glory!

With the enthusiastic and uplifting performance of the marketing team, this conference concluded successfully.

In 2021, it was destined to be an exceptionally unusual year. Within this year, the domestic landscape underwent unpredictable changes. On one hand, tech giants faced the pains of anti-monopoly rectification, while the education and training industry plummeted from its capital heights due to the 'Double Reduction' policy introduced by the country. On the other hand, the lingering impact of the COVID-19 pandemic persisted, affecting the fundamentals of offline service consumption industries both domestically and internationally. Many professionals across various industries were busy with self-rescue efforts, lamenting the challenging circumstances.

It can be said that, despite the economic recovery and warming up as a result of pandemic control measures, the overall economic downturn is an undeniable fact this year. Meanwhile, the global and domestic political and economic order is undergoing restructuring. Both China and the United States have entered into a long-term strategic competition, and the pandemic may continue to coexist with us in the long term.

The upcoming year 2022 marks a new era for various industries and sectors. As a high-tech company specializing in financial software training services, banking data integration services, development of financial industry applications, and computer information system integration, Xinda Financial carries a more significant mission and responsibility. Therefore, how to find certainty in uncertainty, how to plan ahead, and how to maintain the spirit of staying true to our original aspirations become particularly crucial for us.

Worth mentioning, as pioneers and leaders in the introduction of international banking core business systems, Xinda Financial has shown a strong momentum and achieved a favorable situation in its progress and work this year. The achievements obtained are not easy, and the stories behind them are equally exciting! Faced with the complex and ever-changing market environment and the frequent resurgence of the COVID-19 pandemic, the proactive team at Xinda Financial has closely followed the market's development, upheld the spirit of sailing against the wind, and initiated a new market layout. Significant accomplishments have been achieved in providing financial information services to banks and insurance companies, promoting the construction of smart banking services, and establishing a presence in areas such as smart payments, intelligent counter systems, and financial e-commerce.

With favorable winds at our back, we set sail towards the future. Now, standing under the challenges and opportunities of the new era, we will continue to implement company strategies related to products, categories, and platforms. Leveraging the company's advantages as a high-tech enterprise in specialization and innovation, we believe that, guided by the correct strategic direction and with the sincere cooperation of all colleagues, Xinda Financial will surely achieve its set goals and usher in a brighter and more splendid tomorrow!

Looking ahead, we will see the passion and courage of our peers who actively learn, innovate, and dare to try new things. On the road to creating better products and services for users, we are not alone. We always approach each choice and exploration with a sense of awe, understanding deeply the mission and tasks we shoulder: to bring better products and services to Xinda Financial and to share the dividends and opportunities that the era has given us.

As we stand at the special juncture approaching the new year of 2022, Xinda Financial is like a youthful individual, having received applause for our past achievements, yet well aware of new challenges and honors waiting in the future. Reflecting on the past is to draw nourishment and strength for the journey ahead, and on the path to new directions, Xinda Financial has always been with you!

A poet once said: 'In the east, there is the fiery red of hope; in the south, there is the warm nest. Chasing the retreating sun in the west, awakening the fragrance in the north.' As 2021 comes to a close, let go of regrets and move forward bravely. All experiences are life lessons. As we approach 2022, may all Xinda Financial employees dispel worries, and may everything be successful.

Finally, we are very grateful for the unwavering support of our valued customers and equally thankful to all colleagues, partners, and the families behind each one of you. It is because of your existence and efforts that Xinda Financial has grown steadily and developed to where it is today. Here's wishing the loved ones behind the employees a healthy, joyful life, grateful for the encounters, and enduring the journey through life's storms and sunshine. May life be hopeful, and the future be promising!

With the comprehensive opening of China's financial industry, competition pressure from global financial markets, diverse customer demands for banking products, increasingly standardized and stringent regulatory requirements, and the rapid development of IT technology, Chinese commercial banks are facing unprecedented new challenges, making transformation imperative! In this process, the core business systems of banks are facing the immediate test brought about by changes in the banking survival environment. The construction of a new generation of core business systems aligned with international standards has become the fulcrum for the successful transformation of banks. Many domestic banks have chosen to comprehensively introduce international core business systems to enhance their core competitiveness. They have also realized that a reasonable, flexible, and loosely coupled IT application architecture is crucial for the overall efficiency of banking IT applications.

As a pioneer and leader in the introduction of international banking core business systems, Beijing Xinda Financial Education Technology Co., Ltd. (hereinafter referred to as "Xinda Financial") has taken the lead in the localization of international banking core business systems. From undertaking the construction of the core business system project for the China Development Bank in 2012 to collaborating with East Asia Bank and Jinan Commercial Bank to build a new international banking core business system, Xinda Financial has been on the road to helping the Chinese banking industry build international core business systems for over a decade. Combining its own years of experience in bank IT system construction with the best practices in the development of bank IT both domestically and internationally, Xinda Financial has summarized and refined the modern IT application architecture for BankingWays 3.0.

BankingWays 3.0 is a modern, advanced, and flexible IT application panorama for banks, representing a comprehensive, internationally aligned framework solution for the financial industry. It integrates the best practices of international financial IT development with the experience of Xinda Financial's over twenty years in local financial services. The design philosophy reflects Service-Oriented Architecture (SOA), adhering to open and loosely coupled design principles. The application system's functionality distribution is carefully planned, covering the banking channel layer, integration layer, product layer, and management layer. Simultaneously, it outlines two foundational platforms for application integration and data integration, along with a series of integration and integration standards. This approach enables the sharing of banking services and information.

Xinda Financial's BankingWays 3.0 entire application architecture is logically divided into the following levels:

Channel Marketing Layer: In multiple forms, it provides customers with a consistent banking experience and comprehensive services through various channels, including counters, online banking, telephone banking, etc. The 'Multichannel Access' in the application architecture service channel layer is designed to address the transformation of branches, centralized backend operations, expansion of self-service equipment and low-counter service systems, realization of low-counter customer service and wealth portals, electronic channel integration, integrated signing, unified interfaces with third parties and products, and other requirements. This design has been adopted by some global and national banks both domestically and internationally, resulting in a significant improvement in customer service capabilities after implementation.

Enterprise Information Layer: The Customer Marketing Layer, from the perspective of the bank's overall business services and products, provides unified customer relationship management and market marketing management. It also integrates the bank's proprietary products and third-party products to offer personalized financial advisory services to customers. Additionally, it provides cash management and financial supply chain services tailored for corporate clients.

Business Service Layer: This serves as the financial product service center and product innovation hub for the bank, encompassing multiple product production systems such as bank deposits, debit cards, loans, payments, and trade financing, providing external services. As the focus of banking business product development shifts from accounting calculation towards business departments, the application architecture design of the business product processing layer needs to enhance considerations in the standardization of business product processes and information integration. Particularly, it requires meeting the streamlined processing needs of front, middle, and back-office functions for credit, fund, and letter of credit businesses, enhancing business processing efficiency, and ensuring the consistency of business information. In terms of accounting calculation, a unified internal settlement function can be employed to ensure consistency in accounting calculations across products and various business branches.

Intelligent Control Layer: With the goal of assisting banks in achieving digital operations and management, this layer focuses on addressing issues related to bank financial management, risk control, performance assessment, and meeting regulatory requirements.

In general, the overall application architecture of BankingWays 3.0 is designed to cater to business line specialization and channel diversification. It takes into account comprehensive support for end-to-end business processes, effectively addressing the dynamic and flexible needs of rapidly changing banking processes.

According to industry experts, facing competition pressure from the financial market, diversified customer demands for banking products, increasingly standardized and stringent regulatory requirements, and the rapid development of IT technology, the transformation of domestic commercial banks has become imperative. Achieving management innovation, technological innovation, rapid innovation of financial products, and service innovation in the financial industry have become the major trends for the future. In this context, the BankingWays 3.0 application architecture facilitates the transformation of the banking business model. Shifting from the traditional business and product-centric model to a new customer-centric, marketing-oriented process banking business model, it ultimately helps domestic banking financial systems move towards internationalization and sophistication.

On April 19, 2022, the company grandly launched two financial software products in Beijing, namely, the BankingWays Distributed Architecture Platform System Software (B@nkGalaxy) and the BankingWays Core Business System Software (B@nkEnsemble). Both of these software products are designed for use in the banking industry, assisting in the integration of banking operations and contributing to the enhancement of overall competitiveness in the banking sector.

The product has entered into contracts with numerous financial and banking clients, running smoothly without errors, and has received numerous praises.

The Chairman and CEO of the company, Zhang Yanfeng, graduated from Beihang University and holds an EMBA from both Peking University Guanghua School of Management and Tsinghua University School of Economics and Management. With nearly 20 years of experience in the banking IT industry, Zhang is well-versed in banking and financial operations. He has authored three financial industry books and holds numerous intellectual property rights in banking software.

Under the leadership of Chairman Zhang Yanfeng, the company has combined practical banking experience to develop dozens of banking software products, notably B@nkGalaxy and B@nkEnsemble. These products have significantly enhanced the banking IT business architecture capabilities and computational performance, addressing the challenges of complex and inefficient banking processes. This has helped banks improve their overall business competitiveness. B@nkGalaxy and B@nkEnsemble are currently serving dozens of banks and insurance companies, substantially enhancing the business capabilities and efficiency of financial institutions. During the press conference, Zhang Yanfeng proudly announced the formal release of these two industry-leading software products.

[BankingWays Distributed Architecture Platform Software (B@nkGalaxy)] is a comprehensive distributed technology system developed by Zhang Yanfeng based on a deep understanding of the characteristics of banking operations and in conjunction with the latest IT development trends. Within this framework, each architectural system level of the system possesses the characteristics of distributed architecture. When a certain system node becomes a bottleneck, the distributed architecture allows for addressing this by adding distributed nodes, providing necessary guarantees for the stability, scalability, and extensibility of the system. [B@nkGalaxy] has a complete distributed architecture system, mainly reflected in the distributed architecture of data storage and performance calculation. The system can offer relatively universal support for distributed architecture cache access, providing robust computational power assurance for performance nodes in financial systems.

Key features include:

l Vertical and horizontal scalability: The financial application supports a distributed architecture processing mechanism. By adjusting the deployment quantity and method of business instances, it rapidly adapts to changes in system performance loads, enhancing system availability.

l Rapid System Response Capability: Utilizing distributed architecture and caching technology to reduce transaction response time, enhancing the overall operational efficiency of the system.

l Business Big Data Processing Capability: For handling extremely large volumes of data, a lightweight distributed storage and access mechanism is provided, significantly enhancing transaction performance related to such table associations. This approach ensures complete transparency in specific business development.

l Efficient Performance for End-of-Day Processing: Introducing Hadoop mechanisms for parallel computation during the end-of-day process significantly reduces the processing time.

The BankingWays Core Business System Software (B@nkEnsemble) is a new generation core business system developed under the leadership of Chairman Zhang Yanfeng. This product incorporates advanced concepts from international core business systems, emphasizing principles such as 'customer-centric service,' 'financial products as guides,' 'highly parameterized systems,' 'market-oriented banking interest rates,' and 'integrated management of local and foreign currencies.' It meets the requirements for financial product management, application integration, and data services, providing banks, insurance, and other financial institutions with a new generation core business system that ensures quick responsiveness, flexible configuration, and efficient business innovation. This system aims to comprehensively enhance the core competitiveness of banking operations.

The [B@nkEnsemble] system adopts an open distributed architecture platform technology, based on a system Service-Oriented Architecture (SOA) design. It achieves the design goals of 'quickly supporting financial banking business process integration, business process reengineering, and the rapid launch of financial products.' The system functionalities include Product Center, Parameter Configuration, Pricing Models, Account Management, Accounting Engine, Operations Management, Risk Management, various external API interfaces, and the system frontend. It provides modules for Customer Information Management, Organizational Structure Management, and Authorization Management. Additionally, it offers functionality for configuring and managing banking products such as deposits, loans, payment settlements, and fund management through the Product Factory, along with transaction processing capabilities.

Under the leadership of Zhang Yanfeng, the company has provided financial information services to banks and insurance companies through proprietary research and development products. Leveraging its leading advantage in financial business, the company has advanced the construction of smart banking services and achieved comprehensive deployment in areas such as smart payments, intelligent counter systems, and financial e-commerce.

In the future, Xinda Financial Technology will leverage advanced information technologies such as financial cloud services and banking big data to provide comprehensive and systematic IT infrastructure solutions and services for clients in the financial industry. This includes the construction of dual-mode data centers, financial business virtualization, financial information security, and more. This initiative aims to support the IT technology and architecture upgrades for financial users, as well as cross-platform application integration, ultimately enhancing the overall competitiveness of banking operations.